Editor's Pick

The markets extended their decline over the past five sessions and ended the week on a negative note. While the week started on a...

Hi, what are you looking for?

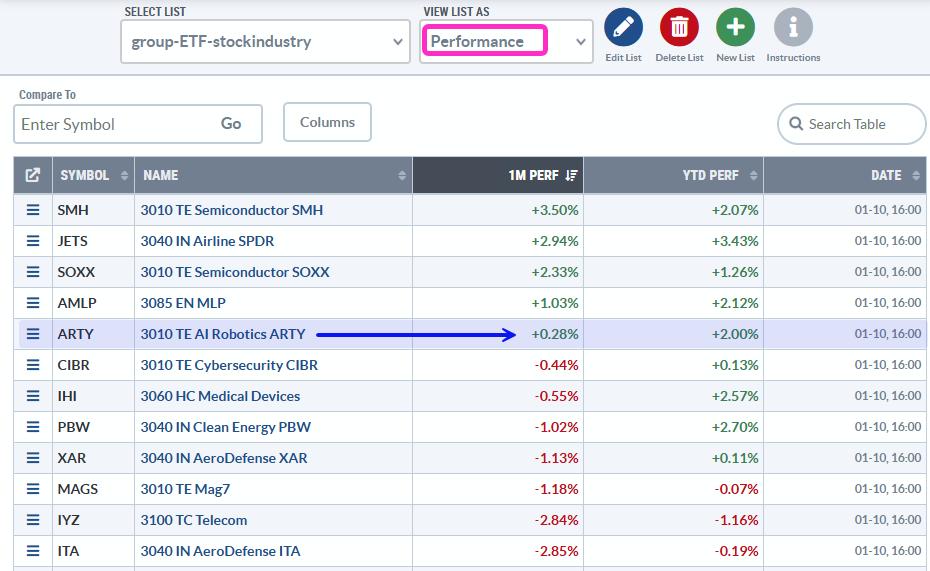

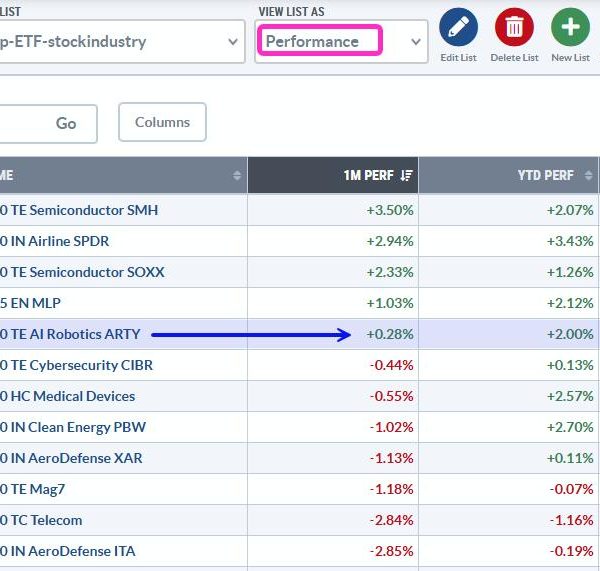

The stock market is in pullback mode with the S&P 500 EW ETF down 5.15% over the past month and down 1% year-to-date. This...

The markets extended their decline over the past five sessions and ended the week on a negative note. While the week started on a...

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also...

In this edition of StockCharts TV‘s The Final Bar, Dave drops an all-mailbag episode featuring viewer questions on the Hindenburg Omen, ascending triangle patterns, Fibonacci Retracements,...

When we think about sector rotation, we think about fundamentally-based forecasts linked to the stages of the economic cycle (i.e. business cycle). In contrast,...

Note to the reader: This is the ninth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.”...

Well, Nvidia did it! A stellar earnings report from NVDA brought back optimism in the stock market. When a stock rises around 15% (for...

On this week’s edition of Stock Talk with Joe Rabil, Joe dives into the world of technical analysis by sharing three unique ways to...

In this edition of StockCharts TV‘s The Final Bar, Dave identifies key resistance levels for QQQ and HYG, along with a technical analysis downtrend checklist for...

In this edition of StockCharts TV‘s The Final Bar, Dave breaks down the latest market breadth indicators, ranging from bullish (S&P 500 advance-decline line) to bearish...

On this week’s edition of StockCharts TV‘s Halftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem....

I begin each year by reviewing the long-term technical positions and behaviors of the “Big Four” — 10-year yields, S&P 500 ($SPX), Commodities, and...