Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

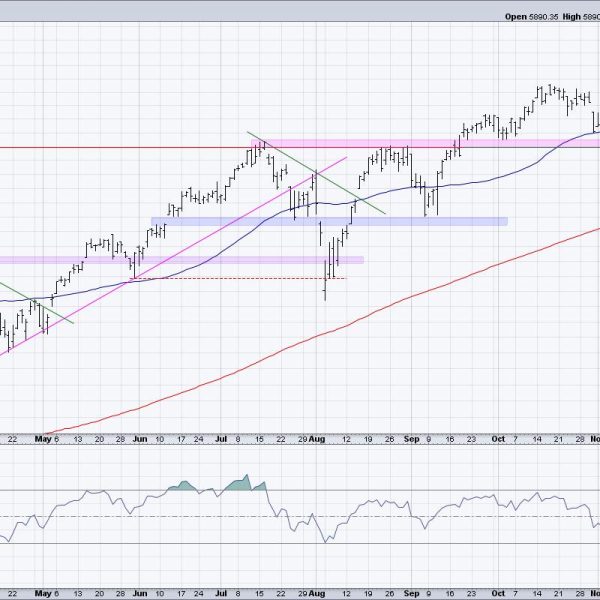

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews investors’ responses to the rise in interest rates after inflation numbers come in higher...

The S&P 500 ended the week with a slight pullback that has this Index closing below its key 10-day simple moving average, but above...

In this edition of StockCharts TV‘s The Final Bar, Dave presents an in-depth discussion on technical analysis patterns, market trends, and risk management. Explore how to...

This month, the SPDR Gold Shares (GLD) broke out to new, all-time highs. That was a significant long-term move, which we will discuss when...

The Oil & Gas Equipment & Services ETF (XES) is showing strength here in March as it breaks back above its 40-week SMA. More...

Micron Technology, Inc. (MU) hit an all-time high of $101.85 last week, but it couldn’t sustain or surpass it. Leading up to its apex...

Note to the reader: This is the twelfth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.”...

In this edition of StockCharts TV‘s The Final Bar, Dave tracks the day’s weaker session, with the S&P 500 and Nasdaq down slightly and the small...

On this week’s edition of Stock Talk with Joe Rabil, Joe explains how to use the MACD crossover signal and the Pinch play signal....

In this edition of StockCharts TV‘s The Final Bar, Dave focuses on the resilient strength in market breadth indicators, suggesting a leadership rotation continues as growth...