Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

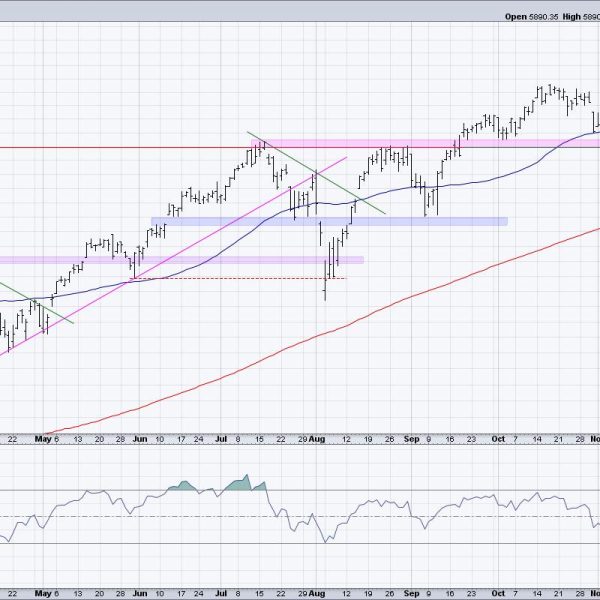

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

In our last piece, we presented a long term/secular outlook for intermediate-term Treasuries, where we concluded that the structural break above the secular downtrend...

In this edition of StockCharts TV‘s The Final Bar, Dave welcomes guest Chris Ciovacco of Ciovacco Capital Management. David focuses on downside risk for GOOGL and...

In this edition of StockCharts TV‘s The Final Bar, Dave recaps the continued leadership rotation from growth to value, with SMCI breaking below $1000 and GOOGL...

Today Carl and Erin open the show with an example of how you can find stock and ETF relative strength using a Price Momentum...

The 20+ Yr Treasury Bond ETF (TLT) failed again at the falling 40-week SMA and looks poised to resume its bigger downtrend. Keep in...

Happy St. Patrick’s Day! Last week was interesting for sure. Both February Core CPI (consumer price index) and February Core PPI (producer price index)...

We have seen just about everything we’ve needed to see to confirm this powerful secular bull market advance since the beginning of 2023. There...

After inching higher for six weeks with intermittent corrective bouts, Indian equities finally took a breather and succumbed to a corrective move as it...

The Nasdaq 100 ETF (QQQ) is beginning to show further signs of deterioration, from bearish momentum divergences between price and RSI to weakening breadth...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews investors’ responses to the rise in interest rates after inflation numbers come in higher...