Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

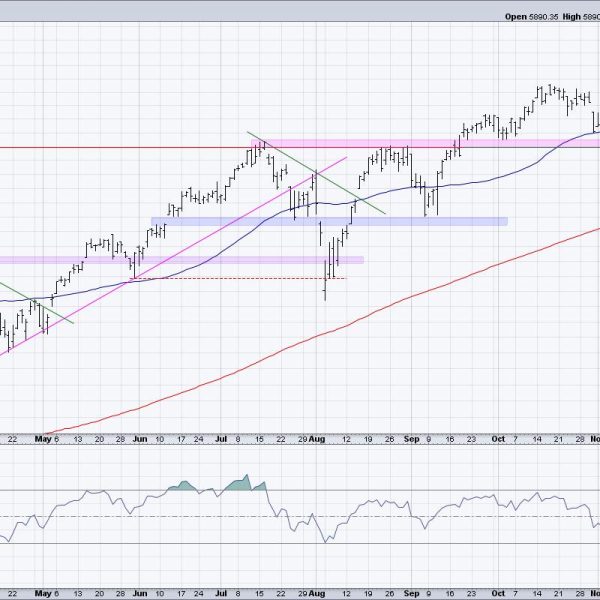

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

In this edition of StockCharts TV‘s The Final Bar, Dave brings you another mailbag show! Explore the differences between RSI and Accumulation Distribution for stocks. Compare...

The big news for Apple Inc. (AAPL) this week was a huge antitrust case from the US government. While the outcome of that particular situation...

It was an action-packed week in the stock market. The FOMC decided to keep interest rates unchanged, and also indicated there could be three...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews what’s shaping up in the broader markets after the Fed announced their rate cut...

Note to the reader: This is the thirteenth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.”...

On this week’s edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the “Big Green Bar” candlestick pattern. This candlestick provides...

In this edition of StockCharts TV‘s The Final Bar, Dave comments on AAPL’s breakdown on antitrust legislation, the breakouts occurring in the homebuilder space, and how...

As a trader, calling market tops (or bottoms) is a difficult and potentially dangerous thing to do. Calling a market top on a fundamentally...

In this edition of StockCharts TV‘s The Final Bar, Dave tracks the S&P 500’s first close above the 5200 level as risk assets pop higher following...

Energy Improving in Three Time Frames Watching sector rotation at the start of this week shows a continued improvement for the Energy sector (XLE)....