Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

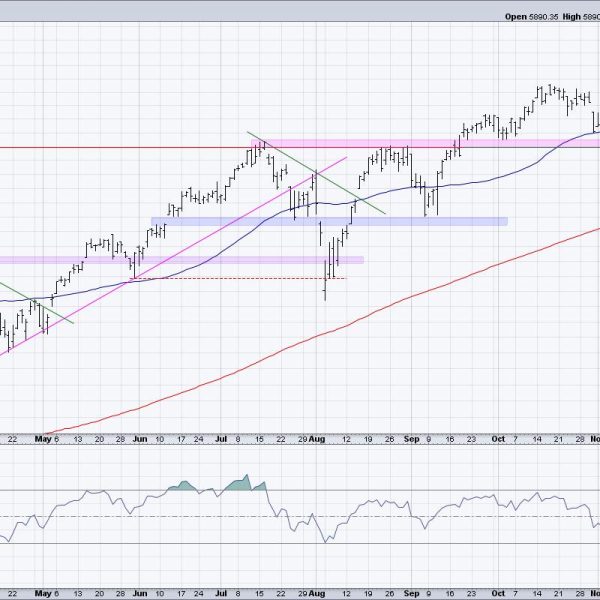

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

My preference is to trade strong stocks that are simply consolidating and ridding themselves of weak hands, hopefully just in time to ride the...

In the previous technical note, it was categorically mentioned that while the markets may attempt to inch higher, they may not form anything beyond...

The Markup Phase of a Bull Market is glorious to behold and participate in. But they do ebb and flow. The bullish run in...

The likelihood of silver reaching $50 an ounce this year is a ‘real possibility,’ according to analysts. More conservative yet bullish forecasts plot silver’s...

Strong Rotation on the Weekly RRG For a few weeks now, the improvement in the energy sector (XLE) is becoming increasingly visible in the...

One day doesn’t make a trend—that’s one lesson we learned from this week’s stock market action. The March non-farm payrolls data revealed that the...

In this edition of StockCharts TV‘s The Final Bar, Dave answers questions from The Final Bar Mailbag. Today he talks about how to use the ADX...

The VIX ended the week just above 16, bringing it to its highest level in 2024. What does this tell us about investor sentiment, and...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen shares what to be on the lookout for to tell if it’s safe to put...

Indices Analysis Summary Continuing from the previous article, the analysis of the various rankings for the indices shows that the data in the table...