Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

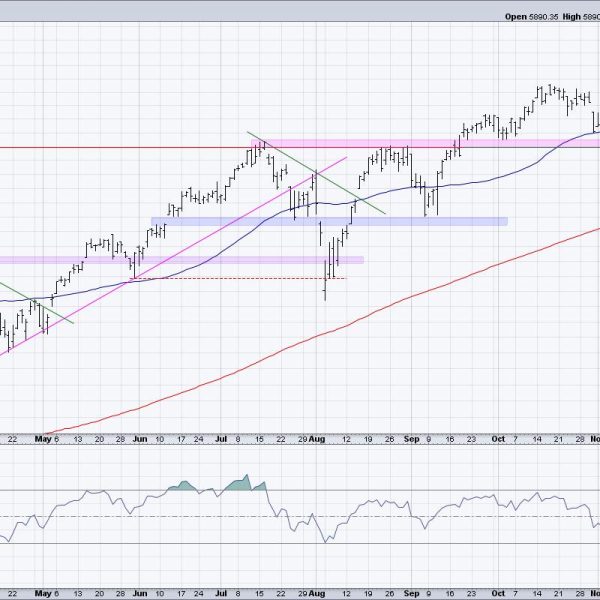

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

Trends often start with outsized moves. But how do we measure and identify such moves? Chartists can measure moves in Average True Range (ATR)...

Now that earnings season has begun, what can you expect the stock market to do, especially after its stellar Q1 run? Well, after a...

The strange thing about gold is that it’s always a relic … until it isn’t. And when it isn’t, everyone swears it’s always been...

On this week’s edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators....

A Sector Rotation Summary A quick assessment of current sector rotation on the weekly Relative Rotation Graph: XLB: Still on a strong trajectory inside...

Sometimes, it helps to look at a stock like NVDA to get a pulse of the market. NVDA’s stock price is up over 85%...

While the world of finance believes risk is measured by volatility (standard deviation), it is my belief that loss of capital is risk, and...

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis. The following chart shows the normal value range of the...

2024 will be marked by a massive string of bank failures!!! Well, according to a few economists on the far end of the mainstream...

In this edition of StockCharts TV‘s The Final Bar, Dave drops a market update, with a focus on Bitcoin’s rebound above 70K, deteriorating short-term breadth conditions,...