Editor's Pick

The market sometimes struggles to find direction, as it digests mixed yet impactful economic data. Wednesday was one of those days. With US 10-Year...

Hi, what are you looking for?

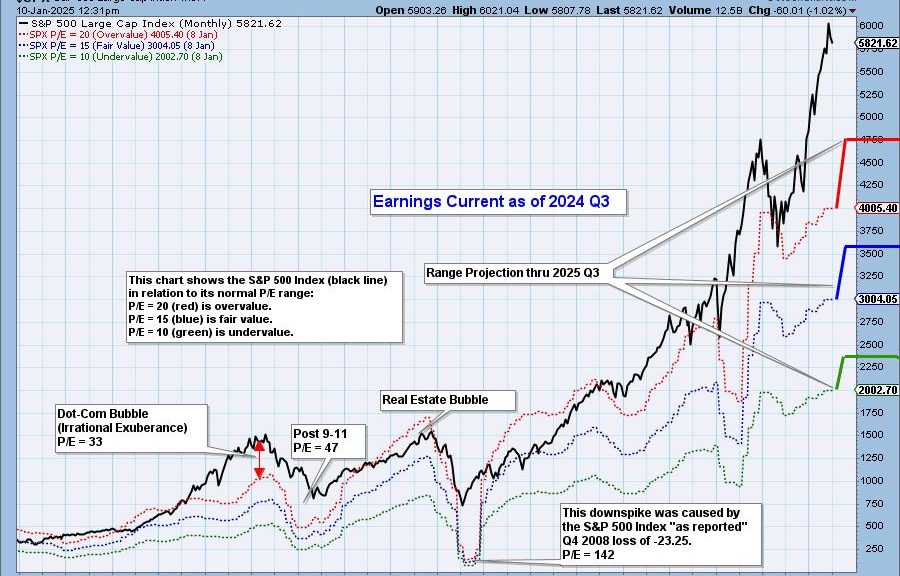

S&P 500 earnings are in for 2024 Q3, and here is our valuation analysis. The following chart shows the normal value range of the...

The market sometimes struggles to find direction, as it digests mixed yet impactful economic data. Wednesday was one of those days. With US 10-Year...

The 10-Year Treasury Yield has gone up a full percentage point, from a low of 3.6% in September 2024 to a level of 4.6%...

Good morning and welcome to this week’s Flight Path. Equities rebounded this week as we saw a string of strong blue “Go” bars and...

The markets had an incredibly eventful week as they reacted to the exit polls and general election results. All happened in the same week;...

Chinese stocks wet on a tear from mid April to mid May with the China Large-Cap ETF (FXI) gaining some 40% and breaking its...

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed...

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024. But what...

When Nvidia (NVDA) opens on Monday, it will have experienced a 10:1 split, and we should remember that one of the purposes of stock...

It was a bit of a seesaw week in the stock market, but, overall, the market seems to think everything is looking good. The...

Breaking Down Into Growth / Value Using Relative Rotation Graphs to help break down the US stock market into various segments can help us...

VanEck Vectors Retail ETF (RTH) is a peculiar beast. It holds 26 retail stocks, 70% in the Consumer Discretionary sector and 30% in Consumer...

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally....