Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

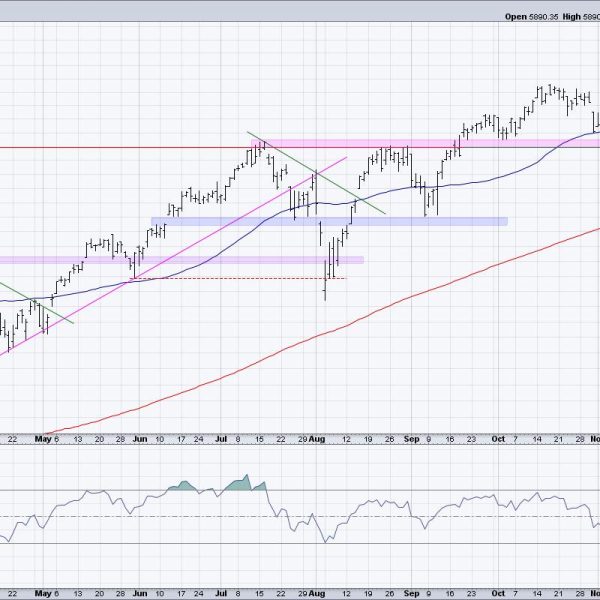

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

One thing I repeatedly talk about is ignoring the talking heads and following the charts. If I had to provide a chart as the...

Despite the volatile moves during the past four sessions in the short week, it was the second week in a row that ended on...

One thing I have found in my time analyzing the markets is that investors love to overcomplicate things. We seem to think that a process...

I spent all of last week, in the media and in print, going over the importance of 2 key indicators. (See the media clips...

In this special edition of StockCharts TV‘s The Final Bar, Dave breaks down the crucial charts shaping October 2023’s financial landscape. This video originally premiered on...

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews the bullish bias that’s shaping up in the markets as high-growth areas begin to...

September’s strong labor market—336,000 jobs added—initially shocked investors. Treasury yields and the US Dollar Index ($USD) spiked higher, while equity futures dropped. But a...

From a bullish perspective, I was hoping to see the “goldilocks” jobs report, one which still showed job growth, but came in below consensus...

We are just about to wrap up the 3rd year of the current presidential term, and head into the 4th year, also known as...

The bond market is doing what the Federal Reserve hasn’t — raising rates. The fear is something is going to break. On this week’s...