Editor's Pick

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

Hi, what are you looking for?

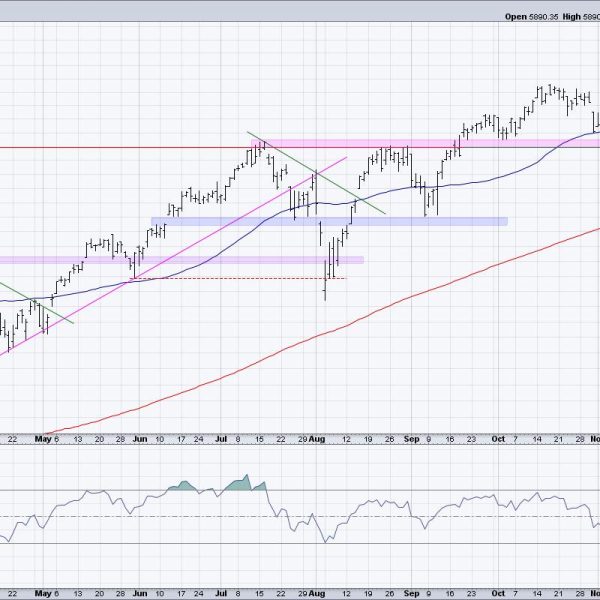

S&P 5850 has been the most important “line in the sand” for stocks since the pullback from the 6000 level in November 2024. With the...

December non-farm payrolls data came in much hotter than expected. More jobs were added, the unemployment rate dipped slightly, and average hourly wages rose....

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop of mixed...

CHART 1: MONTHLY CHART OF SPDR S&P 500 ETF (SPY). Considering everything: Yields and mortgage rates War Inflation and rising commodity prices Bank stocks...

SPX Monitoring purposes: Long SPX 9/28/23 at 4299.70. Gain since 12/20/22: 15.93%. Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78. In the above chart,...

The Home Construction ETF (ITB) led the market the first seven months of the year, but fell on hard times the last two months...

With words like “Schneider’s dedication to educating others about stocks is unparalleled,” Traders World Fintech Awards honors me in the most amazing way possible....

In this edition of StockCharts TV‘s The Final Bar, Dave shares how growth over value is less about the types of companies and more about the...

In this edition of the GoNoGo Charts show, with US Equities delivering a streak of daily gains this week, Alex and Tyler examine the...

Waking up to a new week of geopolitical stress, fake news (Blackrock spot ETF), higher yields, softer dollar, equities rally, I thought to myself:...

In this week’s edition of The DecisionPoint Trading Room, Carl discusses the war’s effect on the market and looks closer at the effects of...

On this episode of StockCharts TV’s Sector Spotlight, after two weeks of absence, Julius de Kempenaer is back with an in-depth look at the current...

Today’s report will compare charts and performance for the Semiconductor ETF (SOXX) and the Semiconductor SPDR (XSD). SOXX represents large-caps and is holding up....