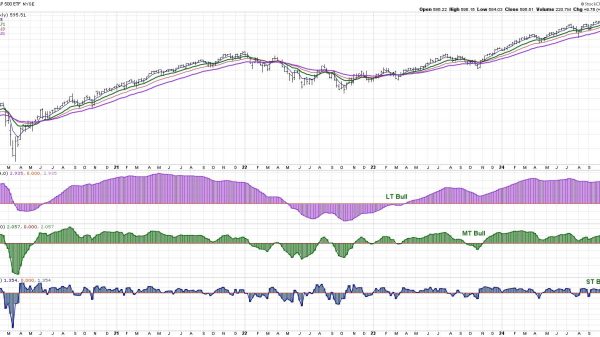

The Goldman Sachs Nasdaq 100 Core Premium Income ETF (GPIQ) has done well this year as technology stocks have surged to a record high. Its total return in 2024 stands at 14.57%, which is lower than Invesco QQQ (QQQ) 17.40% and JPMorgan’s Nasdaq Equity Premium Income ETF (JEPQ), which has returned 15%.

GPIQ vs QQQ vs JEPQ

The GPIQ is a high-yield ETF that was launched on the same day as the Goldman Sachs S&P 500 Core Premium Income ETF (GPIX). Goldman Sachs’s goal was to clone JPMorgan’s highly popular actively managed ETFs. JEPI has accumulated over $33 billion in assets while JEPQ has over $11 billion.

The main difference between GPIQ and JEPQ is that Goldman Sachs’ funds are cheaper, with a net expense ratio of 0.29%. Despite this, it has not attracted substantial inflows from income-focused investors.

GPIQ has attracted just $98 million in assets under management, a tiny amount compared to what JEPI has. This performance is likely because investors have assessed and compared the performance of these actively managed funds and passive ones like Invesco QQQ (QQQ) and the SPDR Technology ETF (XLK).

For starters, the GPIQ ETF aims to benefit from the strong rally in technology companies while limiting the downside. It does that by investing in companies in the Nasdaq 100 index while selling call options of the same.

A sell option is a financial product that gives users the right but not the obligation to buy an asset. In this case, the fund generates the option premium, which it distributes to its investors.

If the Nasdaq 100 index falls below the price, the option becomes worthless since the fund can buy it in the open market for a cheaper price. It then distributes the premium to its holders. Similarly, if the Nasdaq 100 index remains stagnant, it still distributes the premium.

One of the risks for investing in the GPIQ ETF is when the Nasdaq 100 index is in a strong bull run. If the index rallies that much and the strike price is hit, it means that the fund misses some upside.

So, is it worth investing in GPIQ and other covered call ETFs? Historical data, as I have written before on JEPQ and JEPI, shows that the fund underperforms passive funds like the Nasdaq 100 and S&P 500.

The post Is Goldman Sachs’ GPIQ ETF a good Nasdaq 100 fund to buy? appeared first on Invezz