USDCAD and USDCNH: USDCAD fell to 0.35900 this morning

USDCAD made a retreat to 1.35896 levels yesterday, to a new weekly low.

During the Asian trading session USDCNH retreated to a new weekly low of 7.20414.

USDCAD chart analysis

USDCAD made a retreat to 1.35896 levels yesterday, to a new weekly low. However, this morning’s Asian session brought a positive turn as we witnessed the initiation of a consolidation from that zone, leading the pair to recover to 1.36265 levels. We anticipate this consolidation to continue above the 1.36300 level, with the EMA50 moving average providing a strong support level.

While potential higher targets are 1.36400 and 1.36600 levels, we also need to consider a bearish option. A negative consolidation and pullback below the 1.36200 level could lead us to test 1.36000, the daily open price. This would exert pressure on yesterday’s low at 1.35896 levels, potentially pushing us to a new weekly low. In this scenario, we should be prepared for potential lower targets at 1.35800 and 1.35700 levels.

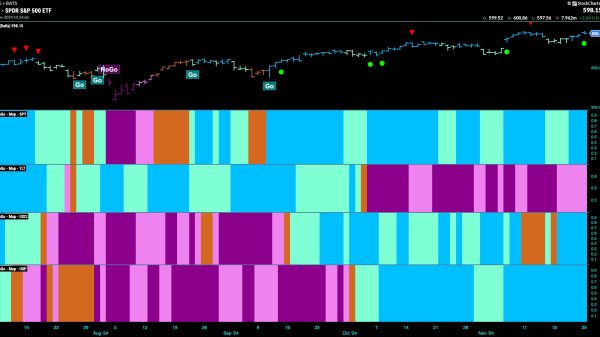

USDCNH chart analysis

During the Asian trading session USDCNH retreated to a new weekly low of 7.20414. After that, we quickly stabilized and started a positive consolidation up to the 7.22400 level. Here we encounter the EMA50 moving average which did not allow us to continue on the bullish side. We turn bearish again and fall to 7.21825 levels. If this consolidation continues, we will test this morning’s low again.

Potential lower targets are 7.21500 and 7.21000 levels. For a bullish option, we need an impulse above the 7.22500 level and the EMA50. By crossing above, we will start a bullish momentum and we can hope for a recovery to higher levels. Potential higher targets are 7.23000 and 7.23500 levels. In the zone of 7.23000 levels we come across EMA200 and there we expect greater resistance to further growth.

The post USDCAD and USDCNH: USDCAD fell to 0.35900 this morning appeared first on FinanceBrokerage.