AVCT Share Price Trends: Get All The Market Insights

Key Takeaways:

AVCT Share Price Chat Stats provide insights for investors to make informed decisions.

Avacta Group PLC specializes in innovative diagnostics and research, emphasizing quality.

Affimer technology has diagnostics, treatments, and research applications, advancing healthcare.

Avacta Group Plc plays a role in biotech, especially in cancer therapies and diagnostics.

With a 42.93% expected price increase by December 2024, consider AVCT for your portfolio during bullish markets. Monitoring share chat discussions offers market insights.

Have you recently wondered about the AVCT Share Price and all the novelties regarding Avacta Group? Were you interested in investing in such an interesting project in the field of medicine and biotechnology?

To achieve investment goals, it’s crucial to comprehend the company’s operations and stay updated on Avacta’s Share Price. For any successful investment, it is very important to be informed about the company, the current situation and the share price, as well as about the experts’ predictions about all of this!

Before discussing stock price and analysis, let’s grasp the company’s market insights and predictions.

What is Avacta Group PLC about?

Avacta Group plc represents a significant player in the Medicine and Biotech sector. It is listed on the FTSE AIM 100 and FTSE AIM All-Share indices. Avacta Group plc boasts a market capitalization of £340.34 million, supported by approximately 283.61 million shares in circulation.

The company is traded under the ticker code AVCT on the London Stock Exchange. Avacta Group plc is a leading UK company in biotechnology and life sciences.

It is dedicated to innovation and specializes in creating advanced solutions for diagnostics and research.

The company’s main products – explained.

The company’s main product is a special technology called Affimer. It can be used for diagnostics, treatments, and research tools.

Avacta Group plc remains dedicated to ongoing research and development and actively engages in strategic collaborations. In doing so, it plays a pivotal role in advancing healthcare and scientific discovery.

The company focuses on quality, precision, and scientific excellence, contributing to the progress of biotechnology and life sciences.

Biotech company focused on cancer therapies and diagnostics.

In simpler words, Avacta Group Plc is a biotech company focused on cancer therapies and diagnostics. They develop innovative products by using unique technologies like Affimer and pre|CISION.

One example is AVA6000, currently in clinical trials for treating certain tumors. They also collaborate with partners like LG Chem and Daewoong Pharmaceutical to advance their projects.

Founded in 2003 and based in the UK, Avacta Group prioritizes good corporate governance to ensure responsible practices. According to Institutional Shareholder Services (ISS), they have good governance standards, showing their commitment to transparency and accountability.

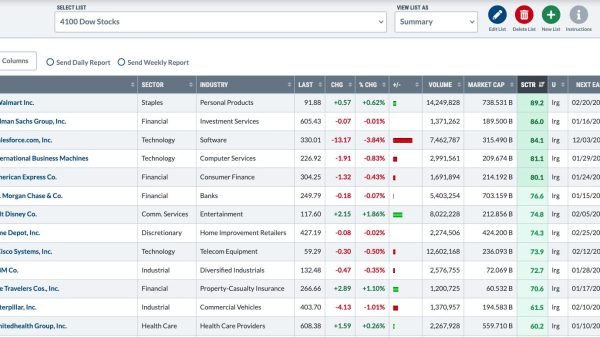

Avct Share Price Chat Statistics

Share Price Avct: $118.500

Bid: 118.00

Ask: 122.00

Change: 1.50 (1.27%)

Volume: 296,727

Open: 118.50

High: 121.00

Low: 118.50

Prev. Close: 118.50

Currency, Shares in Issue and more:

Currency: GBX

Issue Country: GB

Shares in Issue: 283.61 million

Market Capitalisation: £340.34 million

Market Size: 10,000

52 Week High: 187.50

52 Week High Date: 08-Feb-2023

52 Week Low: 89.10

52 Week Low Date: 28-Jul-2023

Number of Trades: 81

Volume Sold: 123,701

Sold Value: £147.83k

Volume Bought: 173,026

Bought Value: £208.01k

PE Ratio: -7.81759

Earnings: -15.35

Dividend: 0.00

Yield: 0.00%

News and Predictions about the AVCT Share Price lse

As of December 2023, the AVCT share price reached $118.500. Since its inception, the Avacta Group Plc avct share price managed to be in an uptrend for about a year. Thanks to the stock’s rising tendency, our experts have almost the same scenario for the future years.

The future AVCT share price is expected to reach approximately $169.36624150432(42.925%). So, as of December 2024, we believe that this share price will be around $142.925

Adding this stock to your portfolio is a good idea, especially during bullish market conditions when trading tends to be smoother.

Summary

AVCT Share Price Chat Statistics provide valuable insights into the stock’s performance and investor sentiment. Share chat refers to discussions and conversations among investors and traders about AVCT’s stock on various platforms, including social media, forums, and financial news websites.

Monitoring these share chats can offer additional perspectives and real-time information about market sentiment, which can be useful for making informed investment decisions.

These chat statistics indicate a dynamic market with a current bid of $118.00 and an asking price of $122.00. The stock has recently experienced a 1.27% change, reflecting investor interest.

With a 52-week high of $187.50 and a low of $89.10, it has shown volatility and potential for trading opportunities.

Investors should watch for news about Avacta Group Plc. They are doing important work in cancer treatments and tests, often with other big companies.

AVCT is a good choice for people looking for growth in biotech because of its commitment to corporate governance. Monitoring share chat discussions can provide additional insights into the reasons behind the stock’s movements and investor sentiment.

The post AVCT Share Price Trends: Get All The Market Insights appeared first on FinanceBrokerage.