Riding the Waves in the Dynamic Stock Market

In the ever-changing landscape of the financial world, investors are constantly on the lookout for the latest opportunities in the market. Recent developments in stock futures have added an extra layer of anticipation, with Wednesday seeing a modest uptick, fueled by investor optimism surrounding the Federal Reserve’s stance on benchmark interest rates.

The Rise of Stock Futures

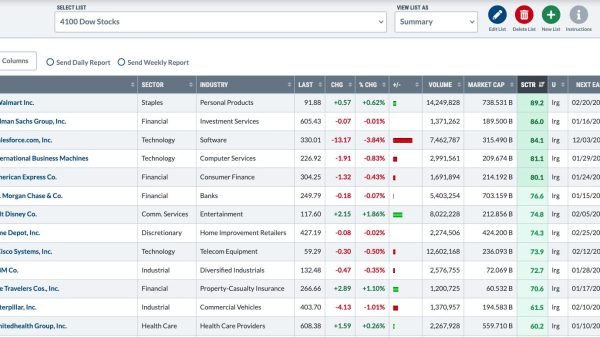

The Dow Jones Industrial Average, an iconic indicator of market trends, showcased a 0.2% increase, while S&P 500 and Nasdaq 100 futures added about 0.1%. These subtle movements might seem modest, but even the smallest shifts in finance can trigger significant market reactions. The question on every investor’s mind is, “What’s next for stock market patterns, and how can one ride these waves to success?”

Market Movers and Shakers

In the aftermath of Tuesday’s after-hours trading, Las Vegas Sands experienced a dip of more than 4.0% due to Miriam Adelson’s decision to sell $2 billion in shares. On the flip side, NetApp saw an 11.0% surge, riding high on upbeat earnings guidance and surpassing analysts’ expectations in the latest quarter. Such events showcase the dynamic nature of the stock market, where individual decisions and corporate strategies become the market movers that influence broader trends.

Federal Reserve’s Impact on Stock Market Outlook

Federal Reserve Governor Christopher Waller’s recent statements added a layer of certainty to the volatile atmosphere. Waller suggested that current monetary policies are sufficiently restrictive to cool inflation down to the central bank’s 2% target. This brought about a renewed sense of optimism among investors, reflected in the modest gains observed in major averages during regular trading. The looming question, however, is whether the Fed will aggressively push back on expected rate cuts for the next year, raising the stakes for investors eagerly awaiting clarity.

Unveiling the Long-Tail: Navigating Stock Market Patterns

Investors, always looking for cues, are closely monitoring fed funds futures pricing, indicating a potential rate cut as early as next spring. This underscores the importance of understanding and navigating stock market patterns. As the financial world evolves, keeping a keen eye on these long-tail indicators becomes imperative for informed decision-making.

The stock market is a dynamic arena where information is power. From the subtle movements of stock futures to the impactful decisions of major shareholders, every detail contributes to the overarching narrative. As we navigate the current stock market landscape, the keyword is adaptability. Investors must remain agile, ready to adjust their strategies based on the ever-shifting winds of financial dynamics. Whether it’s anticipating the next move of market movers or deciphering the intricacies of stock market patterns, staying ahead of the curve is the key to unlocking opportunities on the market.

The post Riding the Waves in the Dynamic Stock Market appeared first on FinanceBrokerage.