Advance Decline ratio explained – definition of ADR

Key Takeaways

Advance Decline Ratio serves as a crucial market-breadth indicator in technical analysis.

Analyzing ADR can signal trend reversals and provide market sentiment insights.

PFP is a significant metric for deciphering bullish or bearish market trends.

ADR can be adapted for varied time periods and trading strategies.

Using ADR alongside other metrics provides powerful financial analysis.

Have you ever questioned yourself about what the advance-decline ratio is? Why is it so crucial to understand it in technical analysis nowadays by numerous technical analysts?

If you want to improve your marketing, investing, or trading career, this indicator is very helpful to learn and utilize.

But why the advance-decline ratio? What are the main reasons for using this indicator so much lately? Let’s get all the basic information about it, shall we?

What Is the Advance/Decline Ratio Exactly?

The ADR is a popular market indicator. It compares the number of stocks going up to the number going down. We base this comparison on their previous closing prices.

The Advance Decline Ratio Line shows the balance between rising and falling stocks over a long period using simple moving averages.

The Arms Index (TRIN) is a short-term indicator. It compares the number of stocks going up with the volume of their trades. Offers in the market are those that influence the index the most.

How to determine the PFP?

To determine the PFP, the number of stocks rising is divided by those falling. Technical analysts are able to analyze the PFP across various time intervals, such as daily, weekly, or monthly. This provides unique insights into market momentum and assists traders in deciphering market trends.

The PFP can show if the market is overbought or oversold. By looking at its path, it can tell if the market is going up or down.

Analyzing the Advance-Decline Ratio

To analyze the advance-decline ratio, divide the value of shares experiencing an upward trend by those on a downward path.

Use this ratio to determine the overall direction of a specific stock or the entire market within the industry.

Types of Advance Decline ratio – explained.

There are two ways to use the Progress/Fall Back Proportions (PFP). The first way is by using it as a single number. The second way is by observing how it changes over time. Also, the PFP might indicate an overbought market with a high value.

Conversely, examining its trend, potentially alongside the moving average, helps discern market directions, with an ascending PFP suggesting a bullish trend.

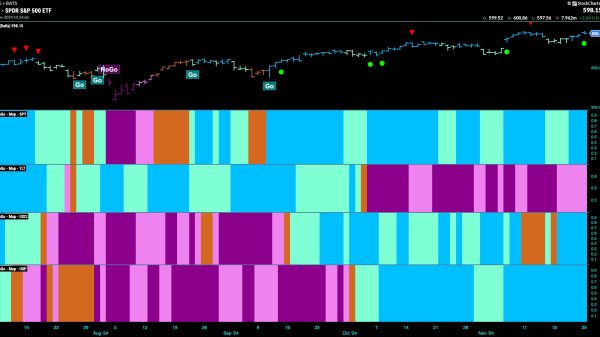

Exploring ADR in Trading: Decoding Market Trends

Investors use the Advance/Decline Ratio (ADR) to analyze the influence of a select few companies on the market. By relating ADR to stock market indexes, they can discern if the market is descending into a bearish trend or encountering an oversold market condition.

This evaluation aids technical traders in pinpointing opportunities for buying and selling. It helps them figure out if the market is worth less or more and predicts possible changes in market direction.

What are the key takeaways from using ADR?

Using ADR in technical analysis and trading strategies teaches important lessons. One of these lessons is the crucial role of ADR in quickly and accurately identifying changes in direction.

Studying the ADR on a price chart in various time frames helps traders quickly see possible price trends or reversals.

What does ADR compare?

Standalone ADR compares advancing to declining stocks. When used with other metrics, it becomes a powerful tool for financial analysis. However, trading solely based on ADR is uncommon.

There are two ways to use the Progress/Fall Back Proportions (PFP). The first way is by using it as a single number. The second way is by observing how it changes over time.

Also, keep in mind that you are able to calculate ADR for various time periods. This calculation provides traders and analysts with a useful metric. It helps them evaluate different trading strategies. Studying the ADR on a price chart in various time frames helps traders quickly see possible price trends or reversals.

Example with Application of Advance/Decline Ratio and Market Analysis

The Wall Street Journal regularly tracks the number of stocks increasing and decreasing in important indices. This provides traders and analysts with valuable information about market trends and sentiments.

On December 31, 2020, there were 2,762 stocks that increased in the NYSE index. Additionally, there were 1,867 stocks that decreased. As a result, the ratio between the two was 1.48.

It affects how and where listings are shown, making it important for analysts and traders in complex financial markets. Just the previous week, the NYSE saw 2,780 advancers versus 1,782 decliners, resulting in a ratio of 1.56.

This data type is pivotal for technical analysis, providing clues to potential trend reversals and the general market sentiment.

Analysts and traders often utilize technical analysis tools to decipher the underlying market trend and anticipate possible future movements.

What should you note?

It’s vital to note that analysts examine offers in the marketplace thoroughly. In our content, you can track and report on how these numbers impact listings, helping you understand market trends.

It affects how and where listings are shown, making it important for analysts and traders in complex financial markets.

Bottom line

Understand the ADR: a crucial market indicator in trading. It compares advancing to declining stocks meticulously, offering insight into market momentum and trends.

Its importance can illuminate investment strategies, aiding in discerning market health. When you learn about our editorial, discover how its careful analysis can enlighten investment strategies and spotlight market vitality.

It affects how and where listings are shown, making it important for analysts and traders in complex financial markets.

The post Advance Decline ratio explained – definition of ADR appeared first on FinanceBrokerage.