Stock Futures Rally and Surge in Trading Activity

In the fast-paced realm of finance, staying ahead of the curve is essential for success. Amid the ever-evolving landscape of investment opportunities, single-stock futures have emerged as a powerful tool for seasoned investors and newcomers. As U.S. stock futures rebound and trade higher, it’s the perfect time to delve into the world of financial technology, or fintech futures, and explore how these instruments can shape your investment strategy.

Navigating Market Volatility with Single Stock Futures

The recent rollercoaster ride in the stock market has left investors seeking stability. Dow Jones Industrial Average futures have seen their fair share of ups and downs, emphasizing the importance of diversification and risk management. This is where single stock futures come into play.

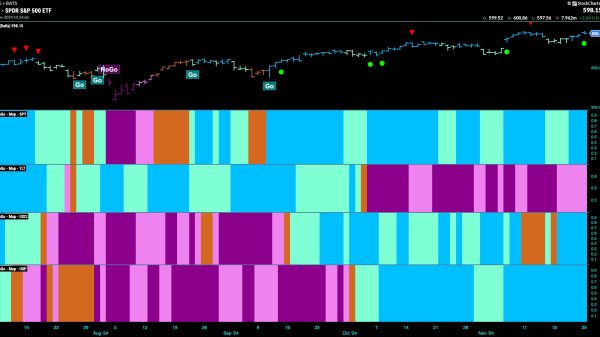

In the latest financial market developments, Dow Jones Industrial Average futures experienced a notable rise, marking an increase of 84 points or 0.25%. Simultaneously, futures linked to the S&P 500 demonstrated a climb of 0.32%, and Nasdaq 100 futures saw a gain of 0.3%.

However, the positive outlook did not extend to all sectors, as shares of Costco faced a downturn, falling by 2.5% during after-hours trading. Despite reporting a growth of 1.1% in comparable sales year over year for its fiscal fourth quarter, Costco’s performance in the U.S. showed a more modest advancement of 0.2%. Nonetheless, the company managed to surpass analysts’ expectations on both the top and bottom lines for the period.

Investors eyeing the technology sector, in particular, can turn to Nasdaq futures. The Nasdaq 100 futures index forum provides a platform to trade some of the most influential tech giants, offering exposure to companies like Apple, Amazon, and Microsoft. Whether you’re a tech enthusiast or simply looking for growth opportunities, Nasdaq futures can be a valuable addition to your portfolio.

FTSE Futures and Global Diversification

While U.S. stock futures often take centre stage, global diversification is a cornerstone of savvy investing. The FTSE futures index, representing the Financial Times Stock Exchange 100, is a prime example.

The main trading session painted a different picture, with the 30-stock Dow experiencing a significant decline of 388 points, equivalent to a 1.14% decrease, marking its worst performance since March. The S&P 500 also faced a downturn, declining by 1.47%, while the Nasdaq Composite slid by 1.57%.

These market losses were attributed to data concerning new home sales and consumer confidence, which fell short of economists’ estimates. Data from the Census Bureau and the Department of Housing and Urban Development revealed that homes under contract for August totalled 675,000, while economists had projected a figure of 695,000, as per Dow Jones.

Embracing Innovation in a Dynamic Market

In today’s financial landscape, adaptability is key. As traditional investment vehicles face challenges, the rise of fintech has opened new doors. Fintech futures combine the power of financial technology with the flexibility of futures contracts, offering investors innovative ways to engage with the market.

In global economic news, China’s industrial firms have faced a challenging year. Profits for the first eight months of the year registered a double-digit drop of 11.7% compared to the same period in the previous year. However, there is a glimmer of hope as the pace of declines eased slightly in August. Notably, China’s National Bureau of Statistics reported a year-on-year climb of 17.2% in profits for industrial enterprises in August, marking the first monthly growth since the second half of 2022.

The Power of Single Stock Futures and Fintech Futures in a Dynamic Market

In a market that never sleeps, exploring alternative investment avenues like single stock futures and fintech futures can be a game-changer. In times of market volatility, such as the recent rollercoaster ride, single stock futures have proven to be invaluable. They enable diversification and effective risk management, essential aspects of any successful investment strategy. The surge in Dow Jones Industrial Average futures, along with gains in S&P 500 and Nasdaq 100 futures, illustrates the potential these instruments offer.

As we navigate the unpredictable waves of the financial world, remember that knowledge and adaptability are your greatest assets. Incorporating single stock futures and fintech futures into your investment strategy can be the difference between merely surviving and thriving in this ever-evolving financial landscape. So, stay informed, stay agile, and continue to seek innovative opportunities that align with your financial goals.

The post Stock Futures Rally and Surge in Trading Activity appeared first on FinanceBrokerage.