Asia-Pacific Markets Rebound, the Best Stocks to Day Trade

In the ever-shifting landscape of global finance, the term “stock market rally” has been making headlines worldwide. While it might seem like a rollercoaster ride, investors follow the ups and downs of the Asia-Pacific markets closely. We will delve into the recent market developments in the region, explore the dynamics of stock finance, and highlight some best stocks to day trade. So, let’s navigate through the exciting world of stock trading in the Asia-Pacific region.

Asia-Pacific Markets Defy Gravity

Despite recent turbulence in global markets, Asia-Pacific markets have shown remarkable resilience. As reported in the source, these markets have reversed earlier losses and are now trading mostly higher. Australia’s weighted inflation rate, meeting expectations at 5.2% YoY in August, was a significant factor. The Japanese Nikkei 225 rebounded by 0.18%, and South Korea’s Kospi also made gains, snapping an eight-day losing streak.

Hong Kong’s Hang Seng index, particularly, witnessed a remarkable turnaround, rising by 0.88% and recovering from Tuesday’s losses. Even the mainland CSI 300 index joined the rally with a 0.39% increase. This impressive performance in the face of global economic concerns demonstrates the robust nature of Asia-Pacific markets.

Navigating Stock Finance in a Volatile Market

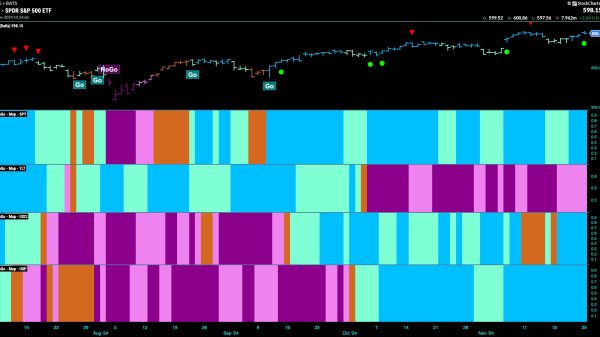

In times of uncertainty, understanding stock finance is crucial for investors. It involves managing your investments wisely to minimize risks and maximize returns. One way to do this is by focusing on the best stocks to day trade, which can provide opportunities for quick gains. Day trading involves buying and selling stocks within the same trading day, allowing investors to capitalize on short-term price fluctuations.

To excel in day trading, it’s essential to stay informed about market news. Keeping an eye on Chinese stock market news can be particularly beneficial, given China’s significant influence on the global economy. By staying up-to-date with developments in the Chinese market, investors can make informed decisions and navigate the volatile world of stock finance more effectively.

The Road Ahead for the Stock Market Rally

As we conclude this exploration of the stock market rally, it’s worth noting that while Asia-Pacific markets have rebounded, challenges persist. In the United States, recent reports on home sales and consumer confidence have raised concerns about the state of the economy. The Dow Jones Industrial Average, in particular, experienced its worst day since March, underscoring the uncertainty in the global economic landscape.

In Japan, the central bank is divided on when to raise interest rates, given that inflation has consistently exceeded the Bank of Japan’s 2% target. This internal debate reflects the complex nature of monetary policy in today’s world. Investors worldwide will be watching these developments closely to gauge their potential impact on the stock market rally.

The term “stock market rally” encapsulates the dynamism and unpredictability of today’s financial world. Asia-Pacific markets continue to be a focal point for investors, and understanding the nuances of stock finance and identifying the best stocks to day trade are essential for success in this landscape. As global events unfold, it’s clear that the road ahead for the stock market rally will be both challenging and full of opportunities.

The post Asia-Pacific Markets Rebound, the Best Stocks to Day Trade appeared first on FinanceBrokerage.