Hot Commodities: An Overview of TSX Futures & More

The global commodity market plays a significant role in shaping the economy and investment landscape. In this article, we will delve into the latest developments in the TSX futures market, oil prices, and the performance of copper and gold. These hot commodities are vital indicators of economic activity and can provide valuable insights for corporate readers seeking to understand market trends and make informed decisions.

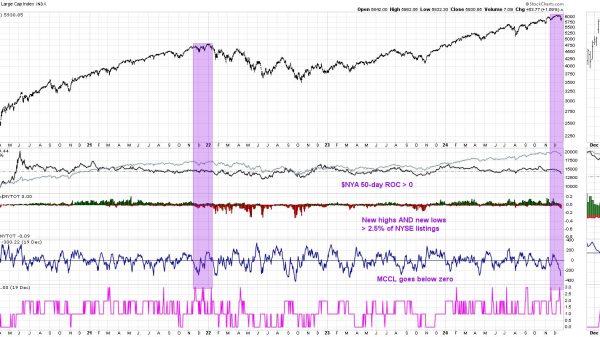

TSX Futures

The S&P/TSX index is a key benchmark for the Canadian stock market, reflecting the performance of various sectors. June futures on the TSX index experienced a slight decline of 0.1%. This drop can be primarily attributed to the weakness in commodity prices, which exerted downward pressure on the overall index. While this decline may concern investors, analyzing the specific commodity markets driving this trend is important.

Oil Price and Copper

On Monday, oil prices and copper experienced a decline, largely influenced by concerns regarding the demand from China, the world’s top commodities consumer. China’s economy is pivotal in driving global commodity demand, making any shifts in its consumption patterns highly impactful. Poor demand prospects from China have created uncertainty in the oil and copper markets.

Oil prices have been particularly affected, with decreased demand leading to downward price pressure. This drop raises concerns for energy companies and investors, as it may affect their profitability and investment returns. Understanding the dynamics of the Chinese market and its impact on oil prices is crucial for corporate readers to make informed decisions about their energy-related ventures.

Similarly, copper prices have also suffered due to worries about China’s demand. Copper is widely used in various industries, including construction and manufacturing, making it a crucial indicator of economic activity. Decreased demand from China can signal slower economic growth, affecting corporate strategies related to infrastructure development, manufacturing, and electrical equipment.

Gold

In contrast to the declines in oil prices and copper, gold prices managed to edge higher on Monday, thanks to a softer dollar. Gold often acts as a safe-haven asset during economic uncertainty, and a softer dollar can increase its attractiveness to investors. The fluctuation in gold prices indicates market sentiment and risk perception. Providing corporate readers with insights into investor behavior and potential economic headwinds.

In conclusion, the latest developments in the commodity market highlight the interplay between various factors and their impact on different commodities, including commodity CFDs. Weakness in commodity prices contributed to a slight decline in TSX futures, reflecting the broader economic landscape. Concerns surrounding poor demand from China influenced the oil and copper markets, while gold prices benefited from a softer dollar.

As corporate readers, understanding the dynamics of these hot commodities markets is crucial for informed decision-making. Keeping a close eye on developments in the TSX futures, oil, copper, and gold markets and exploring opportunities for commodity funding. Such commodity funds through a reliable commodities trading platforms will help businesses navigate risks and seize opportunities.

The post Hot Commodities: An Overview of TSX Futures & More appeared first on FinanceBrokerage.