Rolls-Royce CEO Chris Brownridge, like many importers, is aware of President-elect Donald Trump’s plans to impose a range of tariffs on various countries.

However, he remains unperturbed, citing that business has rarely been better for the luxury carmaker, whose products start at $370,000.

The company’s resilience, particularly in the face of potential trade barriers, underscores the unique dynamics of the ultra-luxury market.

Record sales driven by bespoke commissions

The automaker, now celebrating its 121st year, sold over 5,000 vehicles in 2024, achieving its third-highest sales year ever.

This success comes even though the company released updated Cullinan SUV and Ghost sedan models midway through the year, a move that typically slows sales as customers wait for newer versions.

However, this had little impact on Rolls-Royce’s performance.

The company noted that its bespoke commissions, where clients pay premium prices for one-off customizations like specialized stitching or custom clocks integrated into the dash, are a rapidly growing part of its business.

Bespoke orders jumped 10% year over year and Rolls-Royce is heavily investing in this area, spending $370 million to expand such offerings and increase the number of Private Offices (client lounges) globally, where customers design their custom creations.

Bespoke means more time, revenue, and profit

“What we saw was a real increase in demand for our bespoke motorcars,” Brownridge told Yahoo Finance in an interview.

So we saw a real increase in the level of requests coming from our clients for motorcars with features which are very specific and personal to that particular client. And that’s coming off the back of our network of private offices.

For Rolls-Royce, bespoke customizations mean more time to create these unique automobiles, as well as increased revenue and profit.

Although Rolls doesn’t reveal its margin figures for these commissions, generally, customizations generate higher profit margins than standard builds.

Potential tariff impact on the US market

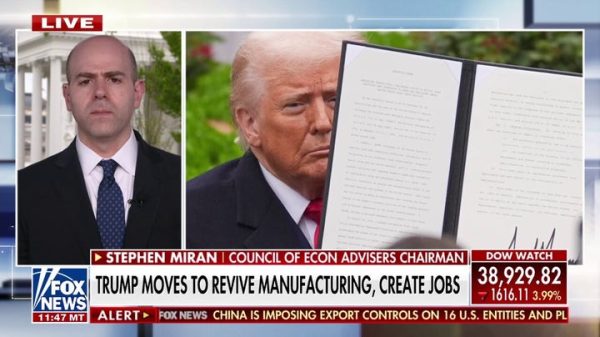

One potential challenge for Rolls-Royce’s growth plans, particularly in the US, which is the company’s largest market, is the threat of tariffs on international goods, particularly luxury goods.

“If you put a tariff on the price of a good, it’s going to have some impact on the demand, … and if it’s a luxury good, there could be higher price elasticity. That’s certainly what I’d expect at Rolls-Royce,” Brownridge said, implying that an increase in price would likely affect demand.

For example, a 10% tariff could raise Rolls-Royce prices by $50,000 or even $100,000 for cars that are customized and optioned in the $1 million range.

Even for Rolls-Royce’s ultra-high-net-worth clientele, such a significant added expense is not desirable.

Global reach provides resiliency

Despite the threat of tariffs, Brownridge remains largely optimistic.

“We’re not dependent on any one market, we have clients in every corner of the world, and that’s the way we run our business,” Brownridge stated.

“But notwithstanding that, the USA is a really important market for us and I think we’re in a great position irrespective of what happens with tariffs,” he added.

This highlights the company’s confidence in its diverse global client base and the enduring appeal of its brand.

The post Trump tariffs? No problem, says Rolls-Royce CEO appeared first on Invezz