The price of palladium experienced a significant drop on Tuesday, falling 5.53% to $925.78 per ounce.

This decline came after the metal reached almost a month-high on Monday, only to surrender those gains as demand appeared to stall and the dollar strengthened.

Broad impact on precious metals market

The downturn in palladium prices was part of a broader decline in the precious metals market.

Gold also saw a decrease, falling 0.37% to $2,325.62 per ounce, while silver dropped 1.36% to $29.18 per ounce. Platinum lost 0.89%, selling for $989.33 per ounce at the same time.

This broader decline in precious metals is partially attributed to a stronger dollar, which rose 0.3% to 105.9, with a session-high of 105.9 and a low of 105.5.

A stronger dollar typically makes commodities priced in the currency more expensive for foreign buyers, thereby reducing demand.

Palladium and Apple: what’s the link?

Palladium prices had been on an upward trajectory, with a notable 3% surge last Friday, marking three-week highs and making it the best performing precious metal of the day.

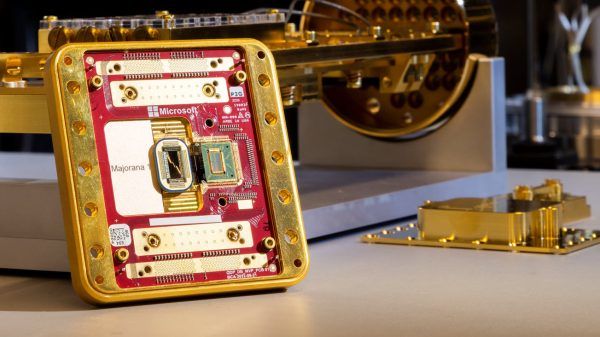

The upward trend continued into Monday, driven by technological advancements and new semiconductor developments.

Apple Inc.’s announcement of its new M5 semiconductor for its Mac gadgets and a report that ByteDance Ltd. and Broadcom Inc. are collaborating on an AI-powered semiconductor bolstered palladium’s price by over 4% to $992.79 per ounce early Monday.

The surge in palladium prices also reflected broader market optimism about the continued use of internal combustion engines, where palladium is a critical component. However, the rapid shift towards electric vehicles (EVs) is likely tempering this demand, leading to volatility.

Technical outlook

Despite the recent surge, palladium’s price pierced the 200-day simple moving average (SMA) line and continued to face resistance at the $950 mark.

A breach above this resistance could push prices towards the next level at $970.

However, the current downturn underscores the metal’s vulnerability to shifting demand dynamics and broader economic factors.

The post What’s going on with Palladium prices? appeared first on Invezz