PlayDapp (PLA)’s 21.23% Drop vs. 15.97% Weekly Surge

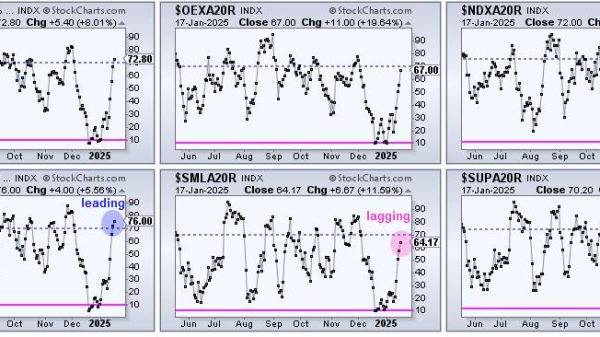

The cryptocurrency market is never short of volatility, and recent price movements of PlayDapp (PLA) offer proof. Currently, the token is trading at $0.1769, marking a 21.23% decline over the last 24 hours. Despite this recent drop, PLA has soared by 15.97% over the past week, showcasing the unpredictable nature of crypto assets.

$19.6M Activity Amidst PlayDapp’s Market Cap Shifts

With a 24-hour trading volume of $19,675,116.88, PLA’s market activity is robust, indicating significant interest from traders. Furthermore, the market cap is at $102,106,116, with a circulating supply of 577,401,393 PLA out of a total supply of 700,000,000. Despite the day’s decline, the token’s performance over the past week suggests broader interest that surpasses immediate price fluctuations.

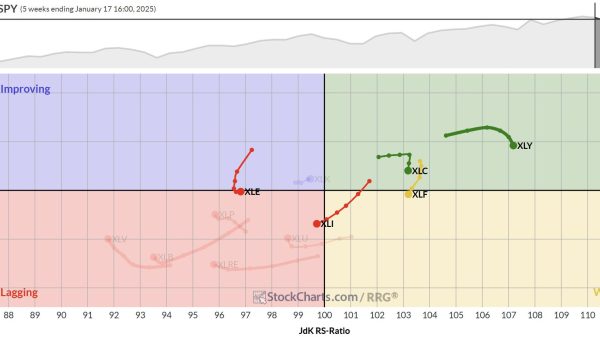

PLA vs. Global Crypto: A Comparative Insight

The broader market dynamics, along with other factors, influence PLA’s recent movements. The token has outperformed the global cryptocurrency market’s 0.50% increase. It has also remained stable compared to its peers in the Polygon ecosystem. This relative performance indicates resilient interest in PLA amidst broader market conditions.

Bitcoin Halving & Ethereum ETF: Market Catalysts

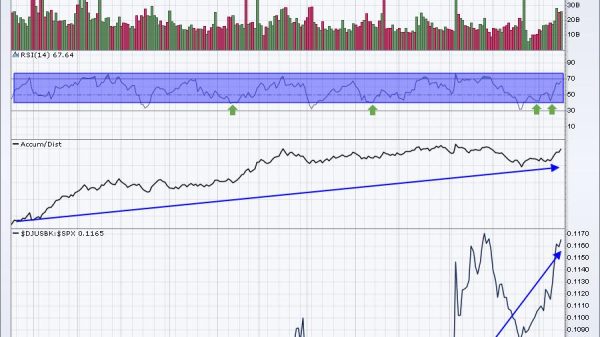

The cryptocurrency market is currently navigating through a phase marked by anticipation of the upcoming Bitcoin halving event and the potential introduction of an Ethereum spot ETF. These events are crucial for understanding the current market dynamics, as they historically signal significant shifts in market sentiment and investment patterns.

Bitcoin’s four-year cycles and the expected halving event between August and November 2025 underline the cyclic nature of the market, which tends to influence altcoins, including PlayDapp. Furthermore, Ethereum’s strengthening position, as evidenced by the ETH/BTC ratio, suggests growing confidence in Ethereum’s ecosystem, which could indirectly benefit PLA due to its operation within related blockchain environments.

Future Market Trends: The Token’s Investment Outlook

Investors in PlayDapp and similar tokens should pay attention to the broader market cycles. This is especially true for the implications of the Bitcoin halving and Ethereum’s market position. Although the immediate price action reflects a downturn, there’s a silver lining. The underlying market trends and the upcoming Ethereum ETF present potential upside opportunities.

On the other hand, the market’s cyclical nature is evident. Coupled with significant upcoming events, this suggests a dynamic market environment. While short-term fluctuations are common, there’s a reason for optimism. The long-term outlook could indeed be bullish. Therefore, investors should keep a close watch. Monitoring the market’s response to these events is crucial. After all, they could significantly impact PLA’s price and the broader cryptocurrency landscape.

Navigating PLA: A Strategy for Volatility

The recent decline in PLA’s price, amidst a broader positive trend over the past week, highlights the volatile nature of the cryptocurrency market. While immediate price movements can be concerning, understanding the underlying market dynamics, including Bitcoin’s cycles and Ethereum’s growing influence, is crucial for informed investment decisions.

Stay informed about market developments and new trends to navigate this volatility effectively.

The post PlayDapp (PLA)’s 21.23% Drop vs. 15.97% Weekly Surge appeared first on FinanceBrokerage.