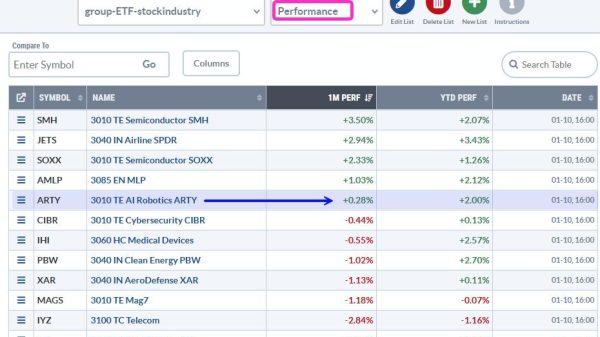

Tech stocks are striking back after a rough start in the first week of the trading year. Back then, it might have been inconceivable to think that tech stocks would lead a bullish rally, but that narrative has changed quickly. Today’s continuation of yesterday’s strong rally boosted the broader equity indices, while the Dow Jones Industrial Average ($INDU) and S&P 500 ($SPX) closed at record highs, and the Nasdaq Composite ($COMPQ) clinched a new 52-week high.

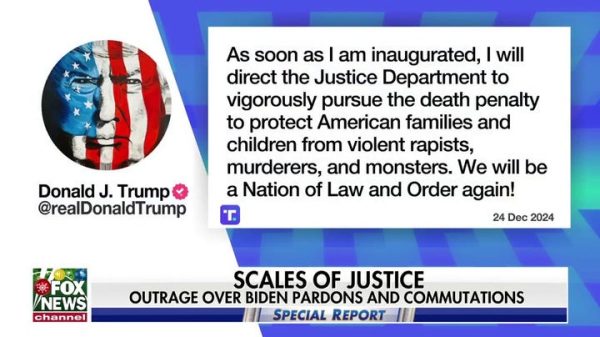

Chip stocks continued to gain momentum after yesterday’s explosive rally, which followed Taiwan Semiconductor’s (TSM) strong earnings report and positive guidance. Perhaps investors are optimistic that other tech stocks will follow suit, as some prominent players report earnings next week, and many more the following week. Early indications suggest that AI will continue to be the buzzword in 2024 and the catalyst for the stock market!

As far as economic conditions go, the US economy is still healthy. Consumer sentiment is high, indicating that the consumer is extremely confident. Earlier in the week, we got a better-than-expected December retail sales report showing that consumers are still shopping. There was some concern that the higher interest rates ahead of the holidays would be a headwind for retailers, but it looks like things went better than forecasted.

There’s a lot of euphoria surrounding the stock market, which spread to mid- and small-cap stocks toward the end of the trading week. It’s a risk-on environment, with investors gravitating toward the Technology, Communication Services, and Consumer Discretionary sectors. Defensive sectors, such as Energy and Utilities, were this week’s weakest-performing sectors.

The Big Picture

A glance at the StockCharts Dashboard gives you an overall view of the big picture. Equities led the rally, with all the equity indexes in the Market Overview panel in the green. The only red is the CBOE Volatility Index ($VIX), which shows that investors are extremely complacent.

The chart of the VIX displays an interesting pattern of choppiness in the last few weeks (see chart below). Earnings season is an exciting time in the stock market, and it isn’t unusual to see some choppiness in volatility. When the VIX is low, it implies that investors aren’t concerned about hedging their portfolios.

CHART 1. DAILY CHART OF CBOE VOLATILITY INDEX. The VIX is low, which indicates that investors aren’t worried about the stock market. When the VIX starts climbing higher, it’s time to become cautious, as it tends to spike quickly and without much warning.Chart source: StockCharts.com. For educational purposes.

The VIX, considered the fear gauge, is key in identifying shifts in investor sentiment, so it doesn’t hurt to regularly review this chart as you go through your stock market analysis. If you go back over ten years, you’ll see the VIX tends to spike quickly, and the last thing you want is to get caught off guard.

The StockCharts Technical Rank had a handful of stocks that increased by more than 14 points. Ally Financial (ALLY) and Super Micro Computer Inc. (SMCI) are the top two in the Top Up category for large-cap stocks. The chart of these two stocks (see below) shows the magnitude of their move on Friday.

CHART 2. TWO BIG SCTR MOVERS IN FRIDAY’S TRADING. Some stocks saw relatively large percentage up moves. Here, you see a financial and a tech stock seeing substantial gains.Chart source: StockCharts.com. For educational purposes.

So, will the investor optimism continue into next week? There’s not much economic data that will be released next week except for PCE, which is an important one. More important are earnings. In addition to these reports, keep an eye on the momentum and the VIX.

End-of-Week Wrap-Up

US equity indexes up; volatility down

S&P 500 up 1.23% at 4839.81, Dow Jones Industrial Average up 1.05% at 37863.80; Nasdaq Composite up 1.70% at 15310.97

$VIX down 5.87% at 13.30

Best performing sector for the week: Technology

Worst performing sector for the week: Utilities

Top 5 Large Cap SCTR stocks: Affirm Holdings (AFRM), Veritiv Holdings, LLC (VRT); Nutanix Inc. (NTNX); CrowdStrike Holdings (CRWD); Super Micro Computer, Inc. (SMCI).

On the Radar Next Week

Earnings week continues with the first of the Magnificent stocks, Tesla (TSLA) reporting on Wednesday. Other companies reporting include Netflix (NFLX), Intel (INTC), Lam Research (LRCX), KLA (KLAC), United Airlines (UAL), Abbott Laboratories (ABT).

December PCE Price Index

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.