For the new year, we have given you an extensive 3-pronged look at the markets.

First, we have the general outlook for the economy and markets through the Outlook 2024. This is the general outlook for 2024, including the recap of 2023 and how the predictions I made then played out. It includes a comparison in inflation and disinflation patterns of the 1970s and now. It also includes all the indices and the general outlook for key sectors and the bonds, dollar, metals, and so on.

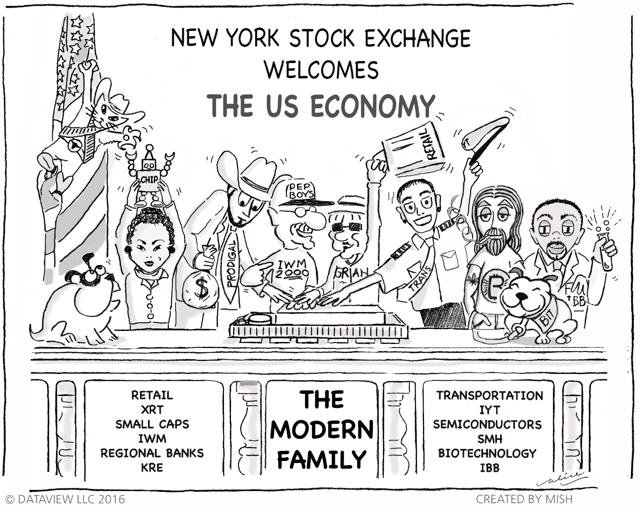

Moreover, we look at the Economic Modern Family and their outliers through charts and analysis. Also included are overall trends to watch, plus picks.

One other area I cover in the Outlook 2024 is the teachings of Raymond Lo and how he sees the upcoming Year of the Dragon. Part of my comments on his analysis is based on this statement by Lo:

“Many has the misunderstanding that the Dragon is glamorous auspicious animal and will always bring good luck. To the contrary, Dragon and Dog in the 12-animal system is called the “Gate to Heaven and Hell” or the “Net of Heaven and Hell”.

General Thoughts

2024 could see gains; however, we are agnostic and definitely looking to charts. SPY needs to hold 4600 as our line in the sand, and small caps need to hold over 2000. Plus, in January, we will have a 6-month calendar reset this year with the election; instruments that fail the calendar range lows could set the stage for a broader selloff, while instruments that rally above the calendar range highs can be the bigger winners, at least for the first half of the year. Nonetheless, we have keen eyes on junk bonds, which, despite rallying, have well underperformed the indices. If they hold, great; if not, we take that as a warning.

With the anticipation of Fed lowering rates multiple times, we also want to see Fed Fund rates stabilize and not fall too dramatically, as those could be the signs of recession that we seemingly avoided in 2023. Additionally, we expounded with Daily newsletters.

From Gold and Silver

For last year’s Outlook, I wrote:

Perhaps our biggest callout for a major rally in 2023 is in gold.

Here we are over $2000 and, although gold has not doubled in price, it did rise by 25%.

For 2024, we stay with our call for higher gold prices. I am looking for a move to $2400, provided gold continues to hold $1980.

That statement was from December 1st. To add to that statement:

Trends for 2024 — Gold and Silver start their Last Hurrah.

From 17 Predictions

With certain areas of inflation coming down, although still higher than what numbers suggest, the discussion of the rate hike cycle at the end is controversial. Statistically, there has been a major financial failure at the end of each rate hike cycle since 1965.

Currently, the catalyst for financial stress could be the rising debt, rising spending, geopolitical issues impacting supply chain and a contentious election year. And anything that gooses inflation will stop the Fed from cutting.

January 2024 will see a new 6-month calendar range reset — it will be very important this time, with many predicting the end of the first quarter with a selloff. Although the stats are on the side of a higher market, this year of the dragon suggests some irritation that could turn the market on its side with more volatility.

To be prepared check out our predictions.

From The Vanity Trade 2024: All About Me!

According to Wikipedia, “Self-help or self-improvement is a self-directed improvement of oneself—economically, physically, intellectually, or emotionally—often with a substantial psychological basis.”

In the Outlook 2024, I quote Raymond Lo yet again,

“The Dragon is considered a ‘Star of Arts.’ The industries that will perform better in the Year of the Dragon will be related to the Metal and Wood elements. Metal industries are beauty and skin care; wood industries are media, fashion….”

This got me thinking about the consumer and the habits of 2023 and how they could continue or change in 2024.

With disposable income still quite high, consumers who spent the last half of 2023 in YOLO or revenge spending go into vanity mode in 2024.

Fashion, beauty, skincare, elective surgeries, self-help, diet drugs, and maybe dating stocks do well.

This daily includes lots of picks to put on your radar.

Click this link to get your free copy of the Outlook 2024 and stay in the loop!

Thank you, all my loyal readers, followers, clients and colleagues, for making 2023 so successful. Here is to a VERY HEALTHY, HAPPY and PROSPEROUS NEW YEAR!!!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Traders World Fintech Awards

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on X @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish and team look at 2023 and make several predictions on commodities and trends for 2024 and vanity stocks in Benzinga Pre Market Prep.

Mish discusses gold, silver and why self care and “all about me” can trend in 2024 in this video from Yahoo! Finance.

Coming Up:

January 2: The Final Bar with David Keller, StockCharts TV & Making Money with Charles Payne, Fox Business & BNN Bloomberg

January 3: Real Vision IP Group Special Presentation

January 5: Daily Briefing, Real Vision

January 22: Your Daily Five, StockCharts TV

January 24: Yahoo! Finance

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): 480 all-time highs, 460 underlying support.

Russell 2000 (IWM): 200 pivotal.

Dow (DIA): Needs to hold 370.

Nasdaq (QQQ): 410 pivotal.

Regional Banks (KRE): 47 support, 55 resistance.

Semiconductors (SMH): 174 pivotal support to hold this month.

Transportation (IYT): Needs to hold 250.

Biotechnology (IBB): 130 pivotal support.

Retail (XRT): The longer this stays over 70.00 the better!

Mish Schneider

MarketGauge.com

Director of Trading Research and Education