China’s Yuan Slips as China’s Youth Unemployment Soars

China’s economic landscape has been subject to significant fluctuations in recent times, with the value of the yuan coin experiencing notable changes. The yuan coin serves as a reflection of the nation’s economic strength and stability. As such, it is essential to understand the latest developments surrounding the currency and how it impacts global markets. We will delve into the current state of the yuan coin, examine its performance against the GBP and the USD, and explore the implications of China’s soaring youth unemployment rate.

Yuan Coin Performance against GBP and USD

Amidst the intricate tapestry of global finance, currency exchange rates play a pivotal role in determining economic prospects. For individuals and businesses involved in international trade, understanding the exchange rate between the yuan and the GBP is crucial. The yuan to GBP exchange rate directly affects the purchasing power of British companies looking to import Chinese goods and services.

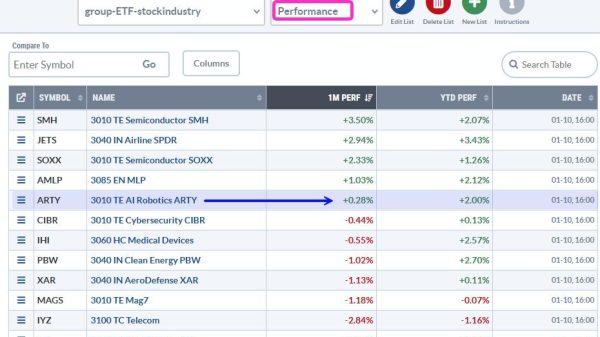

The Chinese yuan experienced a slight decline on Monday in response to the release of China’s latest GDP, employment, and industrial production data. The USD/CNY exchange rate, which is closely monitored by investors, rose to 7.16, surpassing the low of 7.1192 recorded on the previous Friday.

According to the statistics agency, China’s economy expanded by 6.3% in the second quarter, falling short of the expected growth rate of 7.3%. However, on a month-on-month basis, the economy saw a 0.8% expansion, surpassing the median estimate of 0.5%.

These figures indicate a mixed performance for China’s economy during the specified period. While the overall growth rate of 6.3% demonstrates a slower-than-expected expansion, the positive month-on-month growth of 0.8% suggests some resilience and potential for recovery.

In recent times, the yuan to GBP exchange rate has shown fluctuations. As investors evaluate the economic prospects of both countries, the rate can be influenced by a multitude of factors, including interest rates, inflation, and trade policies. Monitoring the yuan to GBP exchange rate provides valuable insights into the economic ties between China and the United Kingdom, facilitating informed decision-making for traders and investors.

Rising Youth Unemployment and Its Impact on the Yuan Coin

China’s youth unemployment rate has experienced a significant surge, raising concerns about the broader implications for the nation’s economy and its currency. With over 100 yuan coin notes, the purchasing power of the younger generation is directly affected by the labor market conditions. The ability of young adults to secure stable employment impacts their disposable income and, consequently, their spending patterns.

The lower-than-expected GDP growth can be attributed to various factors. China has been grappling with challenges such as tightened regulations on certain sectors, supply chain disruptions, and the ongoing impact of the COVID-19 pandemic. These factors have hindered the pace of economic recovery and contributed to the moderate growth rate.

The increase in the USD/CNY exchange rate reflects the market’s reaction to the economic data release. As investors evaluate the performance of the Chinese economy, they adjust their currency positions accordingly. The slight depreciation of the yuan against the US dollar suggests a slightly weaker sentiment towards the Chinese currency.

The correlation between youth unemployment and currency value lies in the overall economic health of the country. If young adults face challenges in finding meaningful employment, it can hinder their contribution to economic growth and stability. This, in turn, can impact the value of the yuan coin. As China grapples with this issue, policymakers must find ways to stimulate job creation and foster an environment conducive to youth employment, subsequently promoting economic resilience and bolstering the yuan coin.

The Yuan Coin’s Significance, Exchange Rate Fluctuations, and the Impact of Youth Unemployment in China

The yuan coin remains a key player in the global currency market, heavily influenced by various economic factors. Fluctuations in the yuan to GBP exchange rate have significant implications for businesses involved in international trade between China and the United Kingdom. Moreover, the rising youth unemployment rate in China adds a layer of complexity to the equation, as it directly impacts the overall economic stability and the value of the yuan coin.

The Chinese yuan experienced a modest slip against the US dollar following the release of China’s GDP, employment, and industrial production data. The lower-than-expected GDP growth rate reflects the challenges faced by the Chinese economy, while the positive month-on-month growth indicates some resilience. It remains important to monitor future economic indicators to gain insights into the trajectory of China’s economy and its impact on the value of the yuan.

As the Chinese government works to address the challenges associated with youth unemployment, it is crucial to monitor the developments surrounding the yuan coin. A stable and prosperous Chinese economy benefits not only the nation itself but also its trading partners around the world. By understanding the interplay between the yuan coin, youth unemployment, and global economic trends, stakeholders can make more informed decisions and navigate the ever-changing financial landscape.

The post China’s Yuan Slips as China’s Youth Unemployment Soars appeared first on FinanceBrokerage.