JP Morgan kicks off earnings season this Friday, July 14th. Goldman Sachs does not report until next week, on July 19th. That is an auspicious day for us, as the July 6-month calendar range will be established. We will be able to see how each bank and banks in general might trend for the second half of the year.

The word on the street calls for mixed earnings performances. Investment banking revenue could be weaker. The recent stress test turned out well, with egional Banks still well underperforming the big banks.

A M&A between the two is on the table. But J.P. Morgan’s stock looks very different from Goldman Sachs stock. Besides revs from asset and wealth management, JP Morgan does lending-related operations, comprised of consumer lending, credit cards, and mortgages. Goldman Sachs provides mainly asset and wealth management. That has not been a highly profitable area of banking in 2023.

JP Morgan has over three times the amount of assets as Goldman Sachs and generates over three times the net revenue. So what could happen to each stock technically?

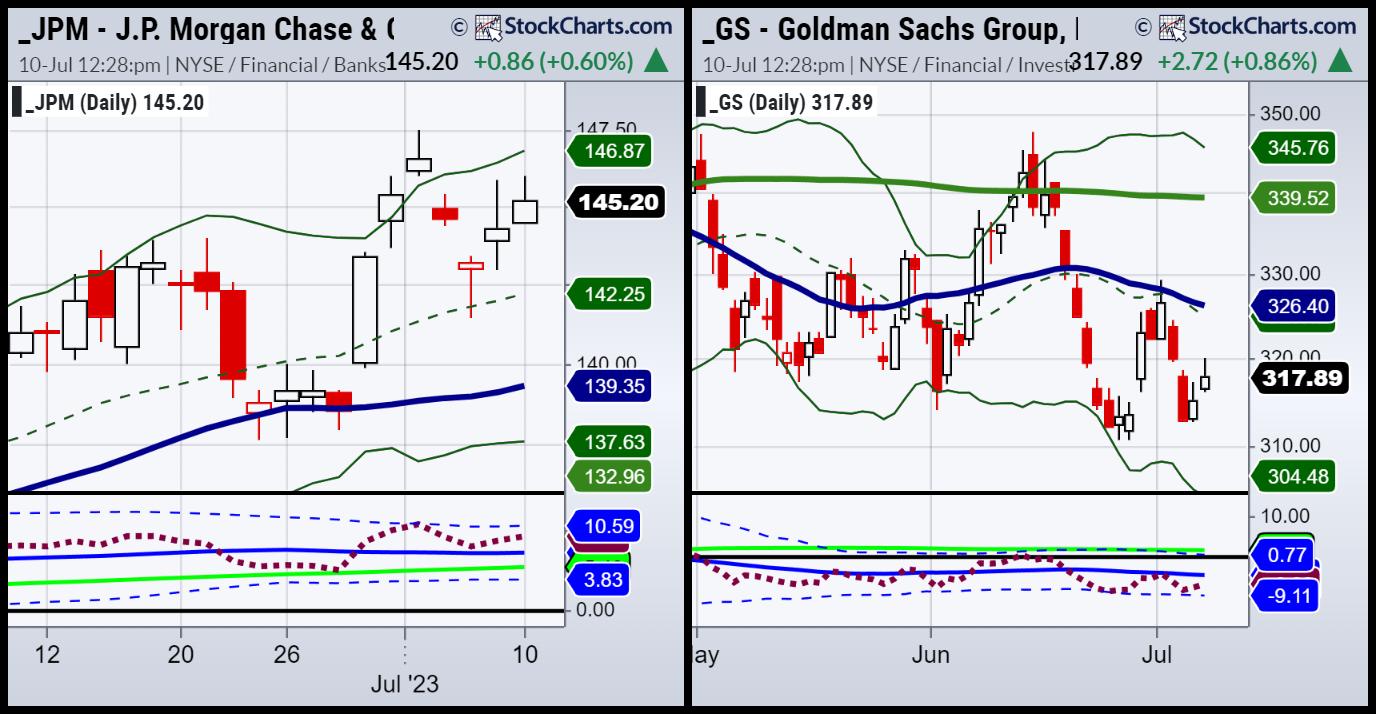

The daily chart of JP Morgan (JPM) is in a bullish phase, and has been for most of the year. However, it has not been impervious to corrections. In late June, we have one example where JPM tested the 50-DMA. On July 3rd, JPM made a new 52-week high and then gapped lower. Our Real Motion indicator shows a similar mean reversion around the same time. Plus, momentum is still sideways, but not as strong as price.

For the earnings, the stock must hold above 140. It also has to take out the reversal top high at 147.50 to keep heading north.

Goldman Sachs (GS) is in a bearish phase. What this chart does not show is the higher lows at every price drop since June 2022. The low from June 28th, followed by the gap higher the next day, is the risk point going into earnings.

Zooming out, GS is not above the 23-month MA, while JPM is. Daily momentum on GS also had a mean reversion, the opposite of JPM’s, as GS is a bottoming one, while JPM is a topping one.

For earnings, should GS clear back over 330, then one can assume the investment banking side of their business is picking up. And that would make sense, as many money managers are throwing in the bear towel and starting to buy. In fact, if you are a contrarian, it could be that JPM’s credit card and lending side falters and the stock drops further into the end of the year. Meanwhile, it could also be that GS sees a boost from the investment side and works its way higher.

The best news? This happens right at the July 6-month calendar reset–a statistically reliable trading range edge. Follow the way the range breaks!

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish, Brad Smith and Diane King Hall discuss and project on topics like earnings, inflation, yield curve and market direction in this appearance on Yahoo Finance.

Mish reviews her first-quarter trades in this appearance on Business First AM.

Mish talks women in the trading space and covers a wide variety of ideas in this interview for FreeFX.

Mish runs through bonds, modern family, commodities ahead of PCE on Benzinga.

Coming Up:

July 12: Imran Lakha Trader Chats & Real Vision

July 13: TD Ameritrade

ETF Summary

S&P 500 (SPY): 440 pivotal and 430 support.

Russell 2000 (IWM): 185 pivotal support.

Dow (DIA): 34,000 back to pivotal resistance.

Nasdaq (QQQ): 370 now resistance with 360 support.

Regional Banks (KRE): 40.00-42.00 current range.

Semiconductors (SMH): 150 back to pivotal number.

Transportation (IYT): 250 pivotal.

Biotechnology (IBB): 121-135 range.

Retail (XRT): Nice move out of the base, but heading into some momentum issues if cannot continue with 66 resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education