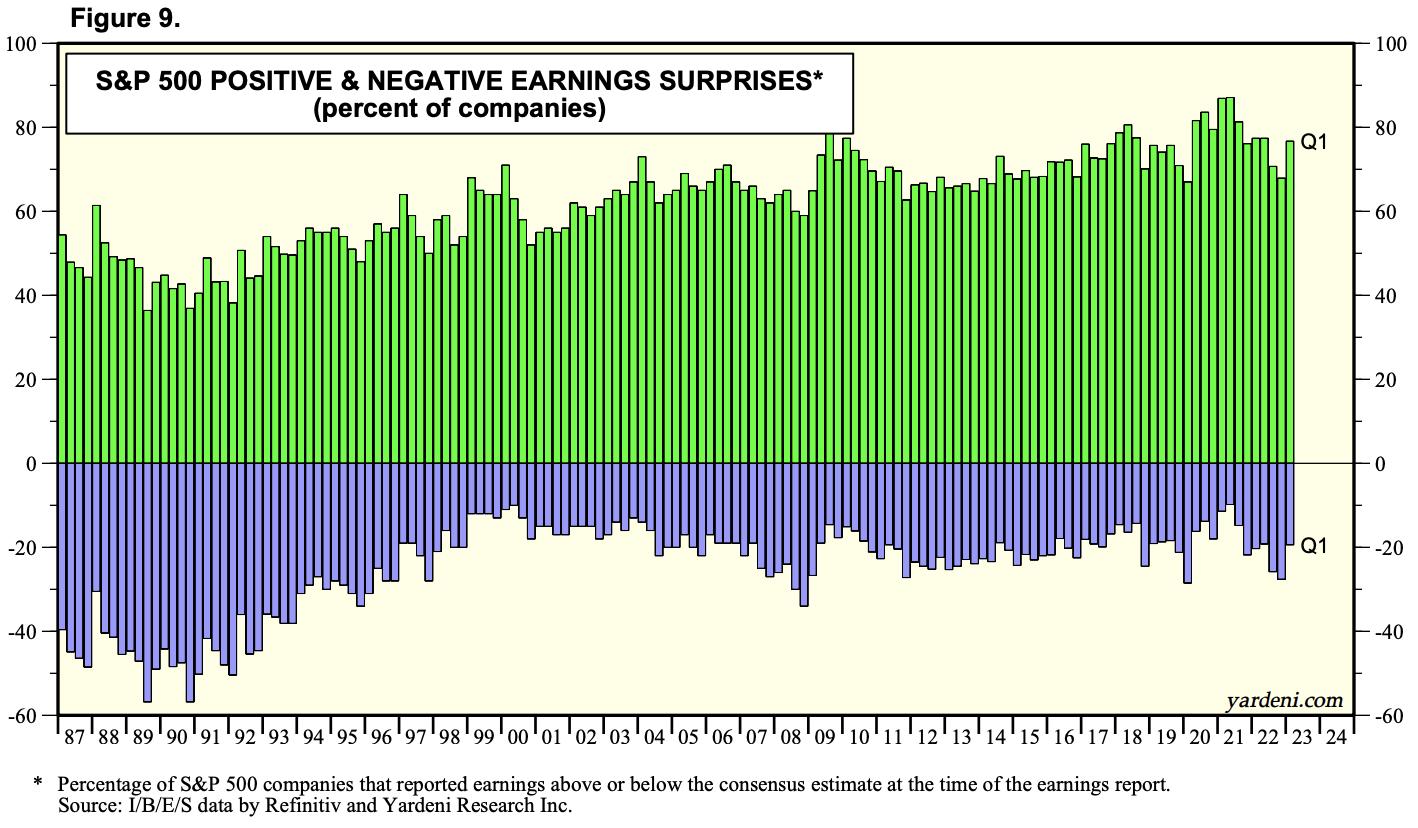

Every quarterly earnings season, we hear the same thing on CNBC and other media outlets. “Earnings are going to be rough this quarter.” Blah, blah, blah. After decades of technical, fundamental, and historical research, I’ve concluded that the games on Wall Street are designed to thoroughly confuse the individual investor. And it’s been my mission for the past several years as Chief Market Strategist at EarningsBeats.com to separate the truth from the rhetoric. The history of the stock market shows quite clearly that most public companies beat earnings expectations. Don’t believe me? Well, here’s a bit of research by Ed Yardeni of Yardeni Research, showing the percentage of earnings beats vs. earnings misses by quarter over the past 35ish years:

Throughout the 21st century, the percentage of companies that have BEATEN consensus earnings estimates is greater than 80%. Greater than 80%!!! But, for some reason, we’re always worried about earnings as we approach the start of earnings season. While Wall Street firms send their finest analysts (I call them “influencers”) out into the world to spread all the bad earnings news we’re about to hear, they’re actually buying stocks hand over fist.

Consider how the S&P 500 has traded throughout each calendar quarter since 1950. I’ve broken down ANNUALIZED performance between the first half of each calendar quarter and the second half:

Q1 (January 1-February 15): +12.49%

Q1 (February 16-March 31): +4.80%

Q2 (April 1-May 15): +13.25%

Q2 (May 16-June 30): +1.15%

Q3 (July 1-August 15): +10.02%

Q3 (August 16-September 30): -4.88%

Q4 (October 1-November 15): +16.24%

Q4 (November 16-December 31): +16.97%

I believe we can make a few observations after studying this performance data:

While everyone is worrying about earnings during the first half of calendar quarters, the stock market’s overwhelming tendency is to RISE.

After the strong earnings are realized, the stock market’s tendency is to struggle.

Q4 doesn’t matter. The stock market just goes up. The two BEST half-quarter performances are found in Q4.

Q3 is the worst calendar quarter of the year BY FAR. We’re in Q3, so we should all lower our expectations.

Let me break down the S&P 500 annualized performance by first half of ALL calendar quarters vs. second half of ALL calendar quarters:

First half of calendar quarters: +13.00%

Second half of calendar quarters: +4.51%

The big Wall Street firms WANT us to worry about earnings and sell so they can line their pockets as prices rise. Then, just after we realize that earnings are solid and start buying, those big Wall Street firms are happily taking profits. Then rinse and repeat. There are so many instances of this. It’s why we all need to be aware of history and to understand how we are manipulated regularly.

If you want to learn more about the ideosyncrasies of stock market timing, I invite you to join our rapidly-growing community of EarningsBeats Digest subscribers. Subscription is completely free and there is no credit card required. And when you sign up, I’ll immediately ship you our e-book, “Money Flows” as a valuable BONUS! CLICK HERE to get your free subscription started and check out some mind-boggling stats!

Happy trading!

Tom