Here is a bullish thought. The Federal Reserve seems to have lost its consensus about higher interest rates. Consider the following:

On the day the Nasdaq 100 Index (NDX) broke out to a new high, 5/18/23, the Federal Reserve’s recently anointed Dallas Fed president, Lorie Logan, noted the Fed had “made progress” against inflation. However, she clarified that unless the data changes – whatever that means – “we aren’t there yet.”

Here are some numbers released around her speech:

Leading economic indicators dropped 0.6%, the 13th straight monthly decline;

Existing home sales dropped in April – the 14th drop in 15 months;

Foot Locker (FL) shares crashed as they missed earnings expectations and commented on slowing consumer spending; and

Regional bank shares sold off once again on remarks by Treasury Secretary Yellen, suggesting that more bank failures may be on the way.

On 5/19/23, Fed Chair Powell noted rate hikes may end sooner rather than later as the banking crisis persists. Stocks sold off on Powell’s remarks, but, again, no major damage was done to the indexes, although the market’s breadth, as I discuss below, remained troubling.

Meanwhile, the debt ceiling kabuki theater continued, although the odds of some sort of deal are better than even. They always make a deal when the market starts rumbling. No one wants to be blamed for a preventable economic crash.

All in all, when the Fed starts arguing about the future of rates in public, the odds that the worst is over are likely on the rise.

Trade What You See. The New Buzzword is A.I.

Perhaps the most telling sign as to what the stock market thinks of the Fed and the general state of affairs was the sharp breakout on the Nasdaq 100 index (NDX), which came despite a move above 3.6% on the U.S. Ten Year Note yield (TNX). I’ll have more on both these markets below.

But suffice it to say, that the new buzz in tech is all about A.I. If that feels familiar, think about the dotcom boom, and its close relative Y2K. Both of those “buzz-driven” rallies made fortunes for those who were able to ride them and get off the train early enough.

We may be entering one of those periods.

Playing the AI Megatrend

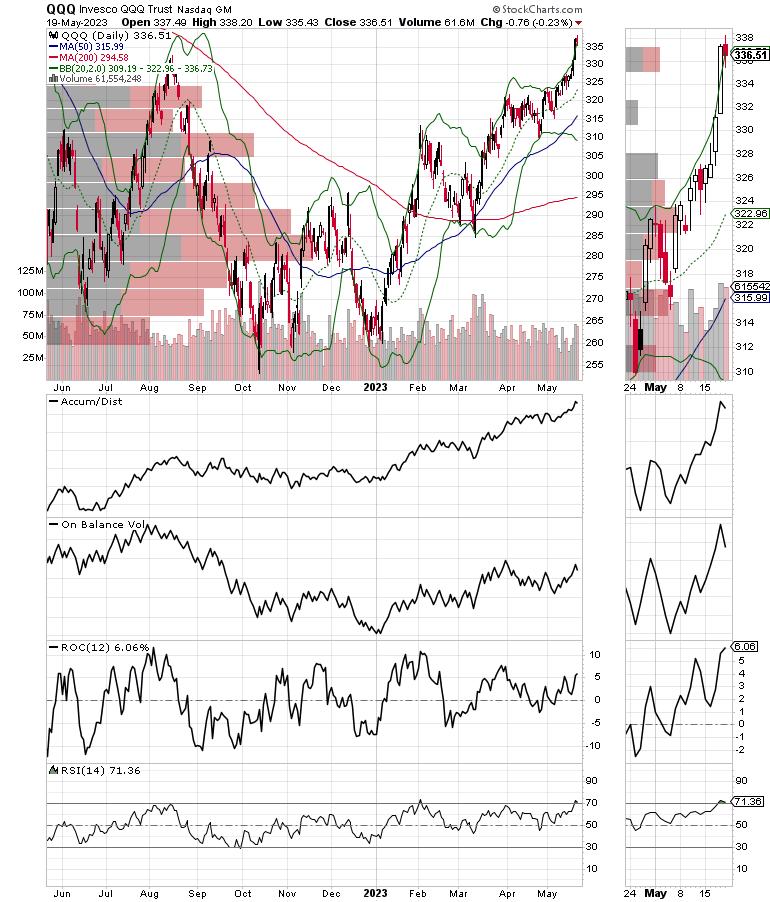

If nothing else, Wall Street is good at creating buzz over technology trends. And this one’s no different than any of the past ones. Thus, when ChatGPT started to gather steam, so too did the Nasdaq 100 bottom out. I detail the recent action in the index below. But, as I noted last week, owning the Invesco QQQ Trust (QQQ), or stocks which are housed in the ETF, has paid off from an investment standpoint.

Note that QQQ, along with NDX, started to bottom out in November 2022, just as ChatGPT started making headlines. Specifically, the big tech bottom began in late 2022, while ChatGPT was “born” on November 30. Since then, NDX, led by a handful of the usual-suspects mega-cap tech stocks, has been on a tear, which culminated with a breakout above 13,300 on 5/18/23.

Microsoft (MSFT), Alphabet (GOOGL), and Apple (AAPL), among others, have broken out to new highs, because of their association or potential association with A.I. Of the three, the most reliable as a bellwether for what’s likely to happen in the A.I. segment is Microsoft. That’s because an increasing percentage of its earnings is coming from its cloud services division.

Another high flyer on the A.I. whirlwind has been Nvidia (NVDA), long known for its next generation gaming chips and more recently for its association with A.I. via its graphics processing unit heavy lifting data processing chips (GPU).

My point is that it’s clear A.I. is going to be something to deal with as an investor for the next few years. At the same time, it’s a bit mindboggling that the biggest beneficiaries of what should be a breakthrough technology are stodgy old tech companies like Microsoft, instead of a startup or two who delivered the technology and are making it available.

For the record, the creator of ChatGPT, Open AI, is still described as a Unicorn and is not publicly traded. Of course, knowing Wall Street, that could change sooner rather than later, unless of course someone buys the company out before it goes public.

Moreover, the big tech stocks have come a long way over the last six months and are due for some sort of pause. At the same time, there are still lots of well-run fundamentally sound tech stocks which have yet to pop. In other words, it is not out of the realm of possibilities that, even as the current crop of tech giants consolidate after their heady gains, the next tier will start to pick up steam.

I’ve just highlighted several tech picks which are likely to move higher over time due to the AI craze. You can have a look at them with a free trial to my service. In addition, my latest Your Daily Five video takes a deep dive into AI and how to make reasonable investment choices in the sector.

Bond and Mortgage Roller Coaster Reverses Course

Stock traders weren’t listening to Dallas Fed president Logan, but it seems as if bond traders were, which would explain a move above 3.6% for the U.S. Ten Year note (TNX). Of course, mortgage rates followed. Thus, we may see a bit of a pullback in the homebuilder stocks in the short term.

I expect that, once bond yields roll over, we will see the homebuilders pick up where they left off.

As I’ve noted here for several weeks, the long-term relationship between the U.S. Ten Year Note yield (TNX), mortgage rates (MORTGAGE), and the Homebuilder sector (SPHB) remains intact, as the recent fall in yields and mortgage rates has again led to a rise in the homebuilder sector.

I’m seeing quite a bit of traffic in my usual homebuilder kick the tires haunts, which tells me buyers are picking potential places to make a move on when mortgage rates fall.

For an in-depth comprehensive outlook on the homebuilder sector click here.

NYAD Dances on Tightrope as Potential Divergence Develops

The New York Stock Exchange Advance Decline line (NYAD) continues to walk along the tightrope provided by its 50-day moving average. It recovered from the prior week’s nasty-looking break below its 50-day moving average and remains above its 200-day moving average.

At the same time, however, it’s hard to ignore the fact that NDX, see below, made a new high and NYAD has been lagging. This divergence is concerning.

The Nasdaq 100 Index (NDX) broke out, closing well above the previous resistance level of 13,400, which now becomes support. Both ADI and OBV are moving higher here, as new buyers are causing short sellers to leave at a faster pace.

As with NDX, the S&P 500 (SPX) broke out above the 4100–4200 trading range on 5/18/23, although it did not hold above the key resistance level. On Balance Volume (OBV) is again flattening out as sellers pull back. Accumulation Distribution (ADI) remain very constructive for SPX as short sellers continue to leave.

VIX Holds Steady

The CBOE Volatility Index (VIX) has been stable lately, trading well below 20 since March 2023. This is a positive for the markets, as it shows short sellers are staying away at the moment.

When the VIX rises, stocks tend to fall, as rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public. A fall in VIX is bullish, as it means less put option buying, and it eventually leads to call buying, which causes market makers to hedge by buying stock index futures. This raises the odds of higher stock prices.

Liquidity is Increasing Volatile

The market’s liquidity is moving sideways, but is increasingly volatile as the Eurodollar Index (XED) remains below 94.75. On the other hand, the 94.5 area seems a bit more vulnerable of late. That’s a cause for concern.

A move above 95 will be a bullish development. Usually, a stable or rising XED is very bullish for stocks. On the other hand, in the current environment it’s more of a sign that fear is rising and investors are raising cash.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition—Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader, and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.