AIER’s Everyday Price rose 0.93 percent in January following a decline of 1.3 percent in December 2022. January’s rise was the second rise in six months. The Everyday Price Index is up 6.56 percent from one year ago, with a January 2023 index value (1987 = 100) of 280.7.

Within the Everyday Price Index, the fuels and utilities and motor fuel categories were the top contributors to the January surge, with the largest price declines registering in nonprescription drugs/vitamins and cable and satellite TV/radio service.

On Friday, February 10, the US Bureau of Labor Statistics updated the weights of the consumer price index constituents to reflect changes in consumption activity. Whereas previously the weightings were updated every two years, they will now be updated annually. Among the more consequential changes, rent was adjusted to account for slightly over 25% of the CPI, while used cars and trucks were lowered. In the EPI, the changes to the CPI resulted in a higher weighting of audio discs, tapes, and other media (+1.68 percent), food-at-home (+1.29 percent), and pets and pet products (+0.33 percent), Weighting fell in the motor fuel (-2.05 percent), food-away-from-home (-0.97 percent), and cable/satellite TV service (-0.47 percent) categories. Twelve of the twenty-four EPI constituent weights changed between +/- 0.10 percent.

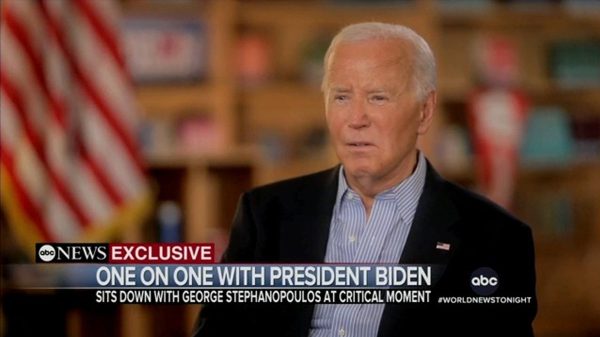

January 2023 US CPI headline & core, month-over-month (2013 – present)

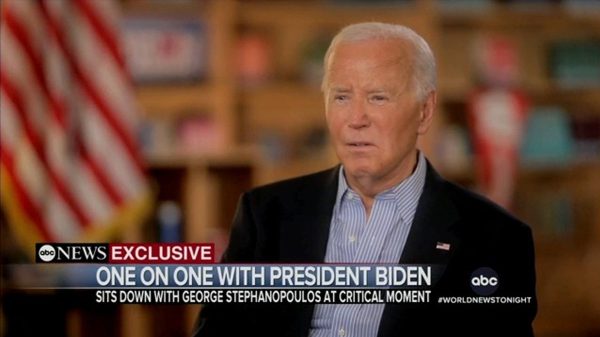

The Bureau of Labor Statistics headline US CPI, which includes food and energy, rose 0.5 percent in January 2023, the largest increase in three months. Year-over-year headline CPI rose 6.4 percent, higher than an expected 6.2% increase. Core CPI in January 2023 rose 0.4 percent month-to-month, with a 5.6 percent increase year-over-year. The latter was, like the year-over-year number, higher than expected.

January 2023 US CPI headline & core, year-over-year (2013 – present)

Some areas contributing to the increase in the CPI, in addition to the weighting changes discussed above, included a seasonally-adjusted 2 percent increase in energy prices, largely driven by gasoline and natural gas. Disinflation slowed in many core goods, yet prices rose in furnishings and apparel. Due to higher fertilizer costs and devastating bird flu, eggs rose 11 percent in December 2022 and another 8.5 percent in January 2023.

Core service prices increased, with shelter costs (the largest services component, making up almost a third of the CPI index) rising 0.7% in January 2023.

Historically, disinflationary episodes have tended to occur at a slower pace than inflations, and persistently elevated prices in certain goods and services–such as we are seeing now–is not uncommon. AIER’s Everyday Price Index indicates that disinflation has slowed more rapidly for households than the broader CPI indices show.

In conjunction with a strong labor market and recent upward adjustments to cost-of-living allowances, it is increasingly likely that with stubbornly high price levels the Fed’s terminal policy rate will be above the previously expected 5 percent level. In addition to weakening economic growth, a contracting money supply, and geopolitical tensions, these factors are narrowing the path to avoiding a recession within the next 24 months.