Inflation has slowed considerably over the past few months. The Personal Consumption Expenditures Price Index (PCEPI) grew at a continuously compounding annual rate of just 1.1 percent from October 2022 to December 2022. Energy prices, which have fallen nearly 7 percent since October, explain a big chunk of the decline in headline PCEPI inflation. Indeed, core PCEPI inflation—which excludes volatile food and energy prices—remains elevated.

On first glance, the most recent data might seem to support the view, advanced by the Biden administration, that much of the inflation experienced in 2021 and 2022 was due to supply constraints.

“We’ve long talked about […] the impacts of the pandemic on supply chains, how that’s impacted a range of costs,” Press Secretary Jill Psaki told reporters in April 2022. “And we know that since the start of this invasion [of Ukraine], because of the reduction of oil and the supply in the global oil market, that that — from Putin’s invasion — that that is a big driver.”

In the time since, we have seen those supply constraints ease up, and inflation is falling.

On closer inspection, however, it is clear that the supply constraints view doesn’t quite cut it. That is not to say that supply chain disruptions stemming from the pandemic and corresponding restrictions on economic activity and Putin’s invasion of Ukraine did not push prices higher. They did. Rather, it is to say most of the increases in prices observed in 2021 and 2022 was not due to temporary supply constraints.

The high inflation rates observed over the last two years were largely the product of expansionary monetary policy. This has become harder and harder to deny as supply constraints have eased up.

The Big Picture

The supply constraints view is inconsistent with the basic facts of the economy today. Think about it. The argument maintains that prices rise above trend when supply disruptions temporarily reduce production. So far, so good. But, if that were the whole story, those prices would return to trend when supply constraints ease up. They haven’t. Whereas production has nearly returned to trend, prices remain permanently elevated.

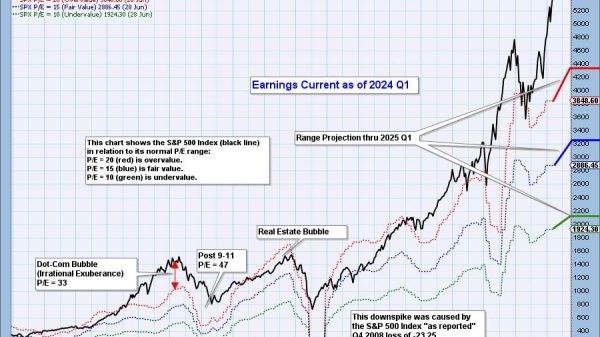

To see this, consider the indices of real gross domestic product (production) and the gross domestic product: implicit price deflator (prices) presented in Figure 1. After a short and sudden decline in 2020, production began to recover. It has not fully recovered. Potential output is probably still depressed to some extent. But the difference between current production and the pre-pandemic trend is much smaller today than it was in the early days of the pandemic.

Prices, in contrast, began rising more rapidly in the first half of 2021—long after the start of the pandemic and well before Russia’s invasion of Ukraine. They grew at a slower rate in the second half of 2022, but show no sign of returning to the pre-pandemic trend. Again: prices remain permanently elevated, despite improvements in supply.

Figure 1. Production and Prices, January 2010 to December 2022.

From the Fed

This week, Fed officials revised their press release to remove references to the pandemic and Russia’s invasion of Ukraine.

“You’ve eliminated all the reasons that you said prices were being driven higher,” Reuters reporter Howard Schneider noted during the Q&A with Chair Powell, “yet that’s not mapping to any change in how you describe policy.”

Powell’s reply appears to be a big admission:

We can now say, I think for the first time, that the disinflationary process has started. We can see that—and we see it, really, in goods prices so far. Goods prices is a big sector. This is what we thought would happen since the very beginning and, now, here it is actually happening—and for the reasons we thought. You know: it’s supply chains, it’s shortages, and its demand revolving back towards services. So, this is a good thing. This is a good thing. But that’s, you know, around a quarter of the PCE Price Index—core PCE Price Index.

Powell goes on to explain that price increases in other sectors, notably housing, are “driven by very different things” and acknowledges that price increases in the core services excluding housing category—which is the majority of the core PCE Price Index—have not yet moderated.

In other words, Powell appears to admit that supply constraints have eased up; that prices previously elevated due to supply constraints have come back down to reflect the improved supply; and that many other prices remain elevated due to factors not related to supply constraints.

This more-than-just-supply-constraints view is also consistent with FOMC projections that inflation will come back down to 2 percent over the next few years, but prices will remain permanently elevated.

Conclusion

I have been complaining about popular-but-wrong views on inflation for a while now. In July 2021, I explained that inflation was not merely returning prices to the pre-pandemic growth path, as many were claiming at the time.

In early October 2021, I noted that monetary policy had been far too loose (an unconventional view at the time) and predicted—correctly, it seems—that the Fed would fail to offset the high inflation. Later that month, I explained how the Fed invited confusion with the word “transitory,” and argued that, although inflation would eventually return to 2 percent, prices would remain permanently elevated.

Fed officials, in contrast, did not acknowledge their error until the end of November. Until then, they continued to suggest inflation was elevated due to temporary supply constraints. And, even then, they delayed acting. They did not take meaningful steps to bring down inflation until May 2022.

With all of this in mind, it surprises me that some still believe that inflation was primarily the result of temporary supply constraints—and that the recent decline in inflation supports their view. They do not seem to recognize the implications of their theory: to wit, that prices would return to trend. I am starting to feel like a broken record.

Fed officials seem to have finally abandoned the supply-constraints view. They now recognize that, while supply constraints have eased up, prices remain elevated.

The Biden administration should admit the error, as well.

Supply constraints were not the primary driver of inflation. Monetary policy was too loose in 2021 and the first half of 2022. The Fed was late to realize nominal spending was surging and failed to correct course promptly when it realized it had made a mistake. Prices are higher today—and will remain permanently higher—as a consequence.

It isn’t Putin’s price hike. It’s Powell’s.